Clive Humby said it best with his oft-cited quote – “data is the new oil.” It is true that the value of data is in its refinement and synthesis into useful insights, tools, and products, all predicated on the existence of a complex infrastructure to share and transport data from where it is found (those with the data) to where the analysis occurs (those with the questions).

The insurance industry is a prime example of how this process can work – how data can be consolidated, shared, sold, licensed, synthesized, analyzed, and leveraged to make informed decisions. But the insurance industry is also a prime example of the challenges to establish and sustain this model long-term (e.g., data can be hoarded, monopolized, withheld).

It's recommended that you view in Full Screen or use the +/- options for the optimal experience.

The Data-Sharing Paradigm

The foundation of the current data-sharing paradigm presupposes that those with the data are willing to share, expose, or otherwise make their data available to those who need or want access to it. There are a host of tools that support the sharing of data, depending on the size of the data and the security required, from emailing spreadsheets, FTP uploads, APIs, to hardware the size of shipping containers to move massive data by road. Sending data is not the primary problem. Trust is the problem for data sharing.

The unwillingness of data owners to share data is not because they cannot figure out how to do it; it is because they do not trust what is going to be done with it once they surrender control of the data. As more organizations that create, use, or store data realize the value of their data – both analytically and monetarily, the more they ask tough questions before allowing access to that data:

The unwillingness of data owners to share data is not because they cannot figure out how to do it; it is because they do not trust what is going to be done with it once they surrender control of the data. As more organizations that create, use, or store data realize the value of their data – both analytically and monetarily, the more they ask tough questions before allowing access to that data:

- What are you going to do with my data?

- How can I be sure that you will only use my data for your stated purpose?

- How can I be sure that you will protect my data as much as I would protect my own data?

- How can I be assured that my competitors cannot use my data to reverse engineer my book of business?

- How can I be sure that you are not going to monetize or productize my data without providing value back to me (or worse yet, sell it back to me)?

The insurance industry has largely addressed these challenges through detailed data sharing agreements, restrictive licensing agreements, and reliance upon a complex web of data vendors, each of which present their own issues. This is not a solution, but a band aid.

Solving the trust issues surrounding data sharing in the insurance industry is a paradigm shift requiring sound answers to tough questions around data security, ownership, and control.

A Shift in Thinking

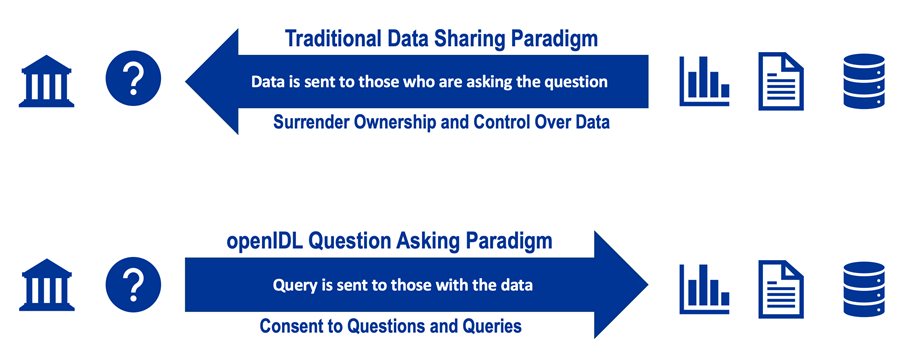

Over the past three years, AAIS has partnered with insurance industry leaders, regulators, and technology innovators through a series of design thinking sessions and proof-of-concepts to develop and test a new technology infrastructure that transforms how data questions get answered. openIDL (open Insurance Data Link) represents a significant paradigm shift that fundamentally turns data sharing on its head. Unlike the traditional paradigm where data is sent to where the analysis occurs, openIDL sends the query to where the data is held (see figure 1 below).

The first goal of openIDL is to clearly define the question being asked of the data in the form of a specific query. It sounds counterintuitive for those who have spent their career saying: ‘Let’s figure out what data we can get our hands on, and then figure out what we can do with it.’ The vicious spiral is disrupted by first figuring out what question we are asking before going to those whose data could help us answer that question.

The first goal of openIDL is to clearly define the question being asked of the data in the form of a specific query. It sounds counterintuitive for those who have spent their career saying: ‘Let’s figure out what data we can get our hands on, and then figure out what we can do with it.’ The vicious spiral is disrupted by first figuring out what question we are asking before going to those whose data could help us answer that question.

At times, carriers have no choice but to provide access to their data, particularly when it comes to compliance-based data sharing for statistical reporting and ‘data calls’ from state Departments of Insurance. In fact, regulators are starting to ask more detailed questions in more complex ways, and more often, as they seek to understand emerging trends and assess the health of the market in their state. The level of data abstraction, the amount of data cleaning required, and the turnaround time required by regulators presents a persistent challenge. Complying with the growing regulatory reporting demand, however, provides a strong motivator for carriers to embrace a new approach that reduces the resources required to comply with regulatory requests and the amount of raw data that leaves carrier control.

Trusting the Process

For too long we have been distracted by the mechanics of moving data, hamstrung by trust issues around sharing data. Once we solve for the trust concerns, we can refocus on the relevant and useful questions that can help all industry stakeholders. The openIDL data-sharing paradigm shift places the focus squarely where it belongs – finding the answers to burgeoning questions. openIDL resolves both of those challenges. Like the often-overlooked infrastructure that transports oil from extraction to refinement to utilization, openIDL represents a long-overdue transformation in the insurance data-sharing infrastructure that promises to revolutionize how we approach the asking and answering of questions in the insurance industry.