The auto insurance landscape is evolving rapidly, driven by technological advancements and changing consumer preferences. The third annual AAIS Driverscape report provides valuable insights into these shifts, helping insurance carriers navigate the complexities of the modern market.

Telematics

Navigating UBI in Auto Insurance: Insights from Driverscape 2024

Sep 5, 2024 / by Ash Naik posted in Issues & Trends, Telematics, Auto, Commercial Auto, Personal Auto, AAIS Webinar Series, auto insurance, UBI, Usage Based Insurance

2023 DriverScape Summary: Auto Consumer Attitude Towards UBI

May 4, 2023 / by Ash Naik posted in Issues & Trends, Telematics, Auto, Commercial Auto, Personal Auto, AAIS Views, auto insurance, UBI, Usage Based Insurance

Personal Auto Insurance is experiencing an unprecedented transformation driven by increasing improvements in telematics. One area leading the transformation is Usage-based Insurance (UBI). While this technology has existed for more than 10 years, it is finally being accepted and adopted by insurance carriers and drivers alike in significant numbers. Fueled by the evolution of telematics, risk models, and pricing; UBI is experiencing quicker-than-anticipated growth. Carriers are presented with new opportunities and challenges unlike any ever before in this new world of technology-driven innovation.

Is UBI Moving Full Speed Ahead? AAIS Report Snapshots Consumer Attitudes

May 20, 2022 / by Ash Naik posted in Issues & Trends, Telematics, Auto, Commercial Auto, Personal Auto, AAIS Views, auto insurance, UBI, Usage Based Insurance

While the telematics capabilities that enable auto insurers to track mileage and driving behaviors continue to advance, Usage-Based Insurance (UBI) has potentially been slow to gain traction among consumers. In keeping with our mission of working with Members to design the best possible insurance products, AAIS recently went direct to consumers to understand the reservations that may be stalling adoption of UBI products and strategies to overcome these obstacles.

Keeping Pace with the Evolving Auto Industry

Nov 2, 2021 / by Ash Naik posted in Community, Technology, Issues & Trends, Data & Technology, Tech News, Telematics, P&C Insurers, Auto, Commercial Auto, AAIS News & Views, AAIS Insights, Personal Auto, Data/Tech, Insurance Line of Business

A Fast-Moving Auto Industry Presents Challenges and Opportunities

The automotive industry transformation continues to have significant repercussions in the insurance industry. With improving sophistication in car technology, telematics, and consumer behaviors, insurance carriers face new and unprecedented challenges spanning the entire lifecycle of the policy from research to claims. Still, personal and commercial auto insurance remain the industry bellwether as the largest product lines accounting for more than $300 billion in annual premiums.

A Data-Driven Future: 2020 Auto Trends

Jun 16, 2020 / by Casey Brewer posted in Issues & Trends, Data & Technology, Insurtech, Telematics, P&C Insurers, Auto, Commercial Auto, Data/Tech, Data Management, 2020 VME, TNEDICCA, AAIS Views

The auto industry is fueling up for new technology down the road. Fully autonomous vehicles and advanced crash-data analysis will all impact not only how the industry operates, but how it is insured as well.

Driving the Future of Auto Insurance

Jul 8, 2019 / by Casey Brewer posted in Issues & Trends, Data & Technology, Insurtech, Telematics, Auto, Commercial Auto, Innovation, AAIS Views, Autonomous Vehicles, AAIS Auto Program

Earlier this year, AAIS surveyed insurance carriers to better understand where they believe the auto insurance market is heading and the challenges associated with the auto technology evolution. After analyzing the responses, the results were clear: change is coming, and the opportunities for AAIS to help Members stay ahead of the curve are great.

Insuring the Ridesharing Economy...Vehicle Sharing and Telematics

Nov 29, 2017 / by Casey Brewer posted in Issues & Trends, Data & Technology, Insurtech, Telematics, New/Emerging Risks, Auto, Commercial Auto

Shared mobility services are not only growing, they also are expanding in scope. Among these trends is the significant increase in vehicle sharing programs. A recent Frost & Sullivan report noted that approximately 7 million users were sharing roughly 112,000 vehicles in 2015 in the United States alone. These numbers are expected to grow to over 36 million users and 427,000 vehicles by 2025. Market revenues are predicted to increase to more than $16 billion within the next five to ten years.

Disruption in the Personal Auto Market

Oct 11, 2017 / by Casey Brewer posted in Technology, Issues & Trends, Data & Technology, Insurtech, Telematics, Auto, Personal Auto

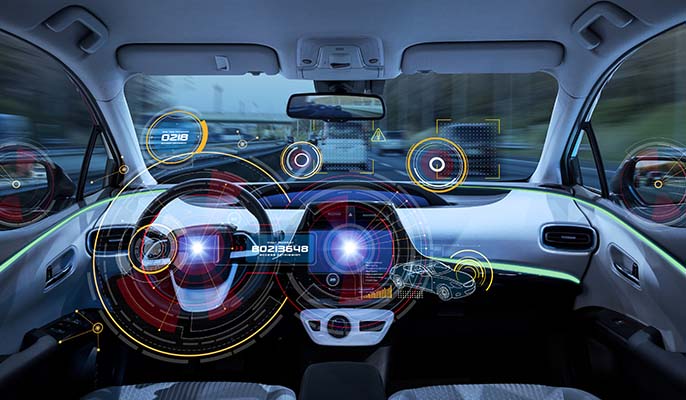

The Greek philosopher Heraclitus is credited with coining the phrase "the only constant is change". Odds are he wasn’t predicting the current state of auto insurance, but those words ring true today as we look at this ever-changing marketplace. Lately there has been a lot of discussion about auto insurance, and varied opinions around the future of the largest line of P&C business. Nobody knows exactly what the auto insurance market will look like in 20 to 30 years, but it will be vastly different than it is today. AAIS Auto Product Manager Casey Brewer outlines the forces currently reshaping the market. Following are excerpts that summarize "The Trifecta of Disruptive Trends" affecting the Personal Auto Insurance market.