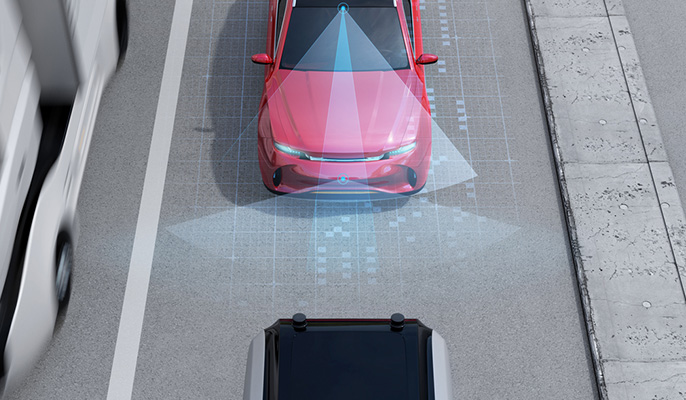

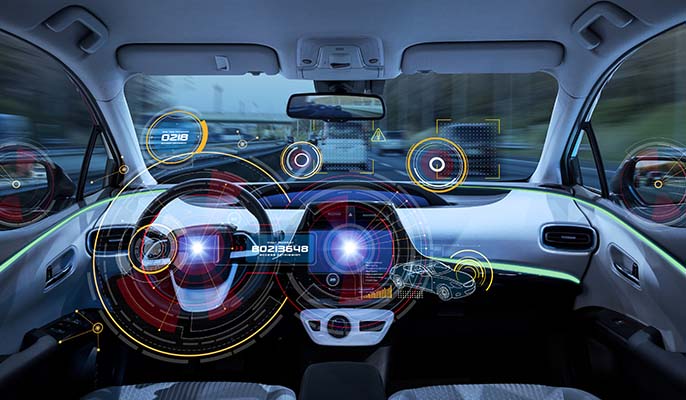

The auto insurance industry faces unique challenges in an era dominated by rapid technological advancements. Today's vehicles, equipped with sophisticated electronics and software, are redefining experiences for drivers, auto services, and insurance industry professionals. In a recent webinar, we explored various facets of auto insurance carriers' challenges.

Tech News

Navigating the Complexities of Automobile Technologies

Jan 3, 2024 / by Ash Naik posted in Technology, Tech News, Auto, Personal Auto, Data/Tech, ADAS

Artificial Intelligence is Modernizing Regulatory Compliance

Jan 18, 2022 / by Robin Westcott posted in openIDL, Community, Machine Learning/AI, Issues & Trends, Data & Technology, Tech News, Regulatory/Compliance, Legislation & Regulation, AAIS News & Views, AAIS Insights, Data/Tech, Connecticut

Risks are continually evolving and emerging, requiring updates to insurance policies in order for carriers to keep pace with market need. Whether you’re a regulator or an underwriter, reviewing new policy language in a timely fashion can be a challenge, and can negatively impact speed-to-market.

Shifting the Data Sharing Paradigm with openIDL

Jan 10, 2022 / by Matt Hinds-Aldrich posted in openIDL, Data & Technology, Data Management/Distributed Ledger, Tech News, Regulatory/Compliance, Modeling/Predictive Analytics, AAIS Insights, Data/Tech, Modeling/Actuarial

Clive Humby said it best with his oft-cited quote – “data is the new oil.” It is true that the value of data is in its refinement and synthesis into useful insights, tools, and products, all predicated on the existence of a complex infrastructure to share and transport data from where it is found (those with the data) to where the analysis occurs (those with the questions).

Increasing the Value of Data

Jan 4, 2022 / by Ruturaj Waghmode posted in Community, Issues & Trends, Data & Technology, Data Management/Distributed Ledger, Tech News, Data, AAIS News & Views, AAIS Insights, Data/Tech

Everyone has probably heard the cliché “Data is an Asset.” But how do we break it down pragmatically into an actionable backlog and apply some “data-driven metrics” toward attributing and increasing the value of data.

It’s a fascinating and challenging paradigm – to increase the value of data. Like many other assets, the value is typically not intrinsic; it must be harnessed. It requires a process of extraction, enrichment, polishing, and packaging. Even then, the value realization is not obvious or guaranteed, until the consumer engages with it. Think of diamonds. They go through an extensive process from rock to finished product, and still only possess value once purchased by a consumer at a defined market rate.

COVID-19 Continues to Impact Auto Insurance Market

Dec 17, 2021 / by Meg Lech posted in Technology, Data & Technology, COVID-19, Tech News, IoT, P&C Insurers, Auto, Commercial Auto, AAIS Insights, Personal Auto, Data/Tech, Compliance, Insurance Line of Business

As the pandemic rolls on, with the omicron variant providing the latest wrinkle, the auto market continues to be reshaped by COVID-19. Aside from the overall financial impact, now increasing claims, severity of claims and higher losses, and worsening consumer behavior are all leaving a mark. Here is the latest from around the industry:

Update from The Farm…Farmowners Product Expanding

Nov 30, 2021 / by Hope King posted in Technology, Issues & Trends, Data & Technology, Robotics/Drones, Tech News, Farm & Ag, P&C Insurers, Farming, AAIS News & Views, AAIS Insights, Data/Tech, Insurance Line of Business, Farmowners (FO)

The farm industry continues to transform. While smaller family farming operations maintain a strong presence and make up a large percentage of the market, we’re seeing growth of large commercial farms that include a variety of operations and layered revenue streams. It is an ultra-competitive market with each company searching for an edge over their competitors.

Value of Blockchain “Sandboxes” Being Realized by Regulators

Nov 17, 2021 / by Robin Westcott posted in Community, Technology, Data & Technology, Data Management/Distributed Ledger, Tech News, Regulatory/Compliance, Blockchain, Legislation & Regulation, Data/Tech

We’re at an inflection point with blockchain technology. A greater community of interest has developed beyond cryptocurrency with the realization that blockchain can solve all types of problems. Insurance regulators nationwide are starting to create “sandboxes,” essentially incubators where new technologies and innovations can be developed and tested, exempt from prohibitive regulations, until a proper regulatory framework can be created.

Keeping Pace with the Evolving Auto Industry

Nov 2, 2021 / by Ash Naik posted in Community, Technology, Issues & Trends, Data & Technology, Tech News, Telematics, P&C Insurers, Auto, Commercial Auto, AAIS News & Views, AAIS Insights, Personal Auto, Data/Tech, Insurance Line of Business

A Fast-Moving Auto Industry Presents Challenges and Opportunities

The automotive industry transformation continues to have significant repercussions in the insurance industry. With improving sophistication in car technology, telematics, and consumer behaviors, insurance carriers face new and unprecedented challenges spanning the entire lifecycle of the policy from research to claims. Still, personal and commercial auto insurance remain the industry bellwether as the largest product lines accounting for more than $300 billion in annual premiums.

Blockchain: The Next Big Thing

Oct 8, 2021 / by Robin Westcott posted in openIDL, Issues & Trends, Data & Technology, Data Management/Distributed Ledger, Tech News, Regulatory/Compliance, Blockchain, Data/Tech, Modeling/Actuarial

In August, AAIS Views detailed the results of our hugely successful Proof of Concept (POC) for openIDL (Open Insurance Data Link) that proved the blockchain technology can dramatically improve the insurance regulatory reporting proves for insurers and regulators. We also saw that insurer information could be correlated with data from other sources to reveal deeper insights, and that data could be leveraged by regulators, while remaining private, secure and in full control of participating carriers

Getting Technical: How openIDL Came to Life

Oct 5, 2021 / by Isaac Kunkel, Chainyard posted in openIDL, Data & Technology, Data Management/Distributed Ledger, Tech News, Regulatory/Compliance, Blockchain, Data/Tech, Chainyard

openIDL, the groundbreaking blockchain technology AAIS developed to streamline regulatory reporting and connect data across the insurance industry has a chance to revolutionize the entire insurance ecosystem. When you peek behind the curtain, you see just how much went into building out this platform collaboratively with stakeholders in the insurance and technology world.