The auto insurance industry faces unique challenges in an era dominated by rapid technological advancements. Today's vehicles, equipped with sophisticated electronics and software, are redefining experiences for drivers, auto services, and insurance industry professionals. In a recent webinar, we explored various facets of auto insurance carriers' challenges.

Here, we will focus on the evolution of automobile technology, safety advancements vs. insurance implications, the effectiveness of safety features, the rising cost of vehicle repairs, the current state of the vehicle fleet, and how AAIS can help navigate these complexities.

The Evolution of Automobile Technology

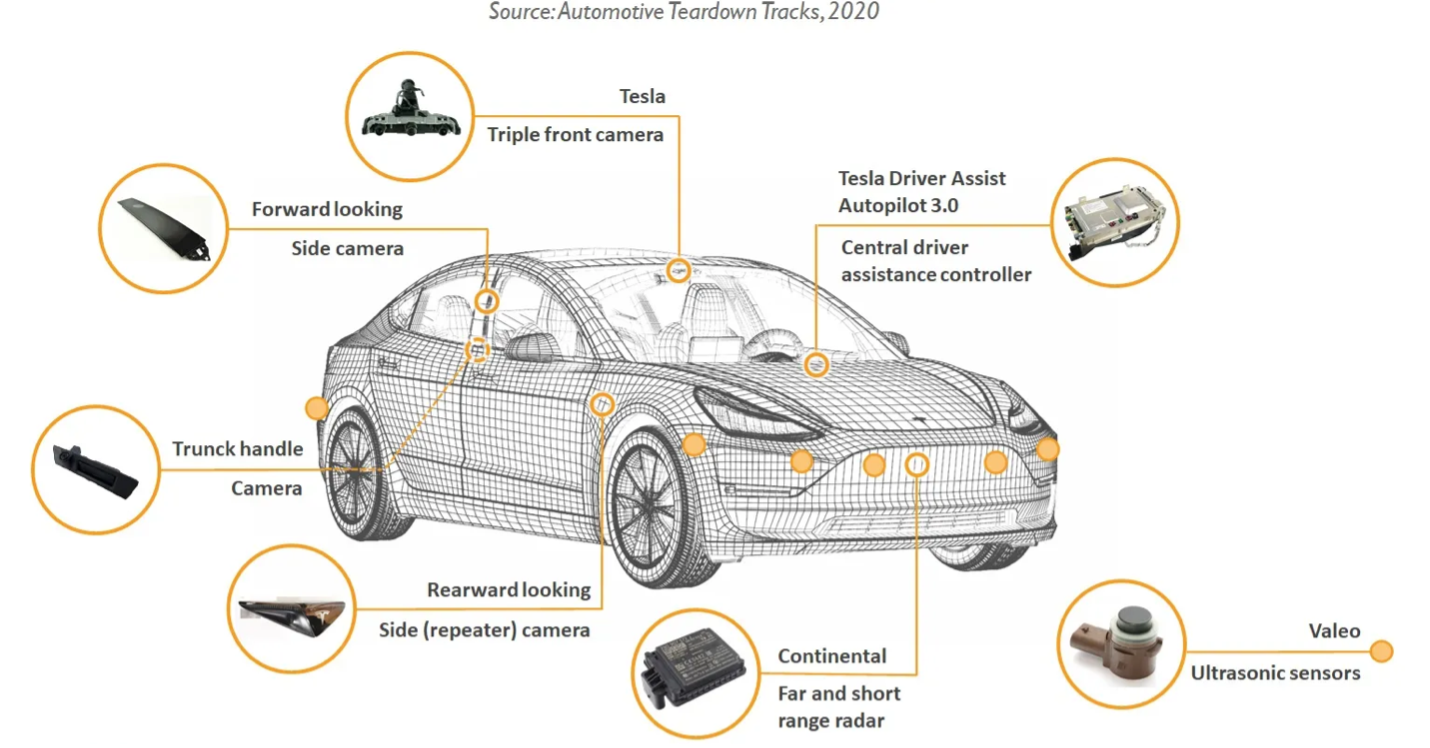

Modern vehicles are more than just mechanical transportation machines; they're a complex integration of mechanical and electronic technology. In many ways, cars resemble iPhones more than motor vehicles of a decade past. Sensors, software, and screens not only improve ride quality but also make vehicles safer with several features.

Tesla offers a 360-degree view of the vehicle's surrounding environment for about 250 meters just by using the data collected by the cameras installed on the vehicles. This feat is achieved through a combination of sensors, software, and techniques that are nothing short of magical.

Most manufacturers offer features that inform and assist drivers on the road. Over the past few years, as features improved and data was collected, some features stood out for their impact in improving the quality of vehicles and reducing crashes.

While technology enhances vehicle safety, it also introduced a new paradox in the form of reduced crashes and increased costs. In our research, this can be attributed to a couple of factors. First, the mix of vehicles on the road; followed closely by the severity of losses due to factors peculiar to the times.

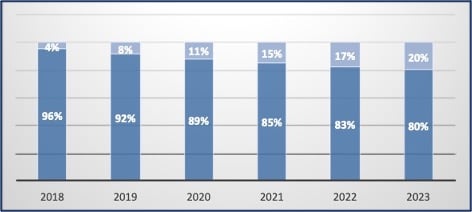

Vehicle Fleet Mix

Innovative technology is not as widespread as we would imagine. Four in five cars do not have proven technology to effectively reduce losses. Looking back over the past five years, we can see that the most useful crash-saving technology was not available even as an option unless consumers chose the higher-end trim levels.

As more data on the effectiveness of AEB (Automatic Emergency Braking) rolls in, manufacturers are beginning to offer these technologies in base-level models, speeding up adoption. This leaves us to contend with longer expected life for the current vehicles.

Increased Claim Severity

The claim experience over the past couple of years has indicated lower claim frequency, offset by higher claims severity. This can be attributed to factors such as:

1. Advanced Vehicle Technology: Modern vehicles often include advanced technologies like ADAS (Advanced Driver Assistance Systems), which are expensive to repair or replace. Technologies such as sensors, cameras, and advanced materials placed in the most vulnerable places are driving up repair costs.

2. Rising Cost of Spare Parts: The cost of auto parts has been increasing, partly due to supply chain issues. While parts take longer to arrive, the costs of rental vehicles are high. This seems to be coming down with reductions in shortages and more standardization of components.

3. Increased Labor Costs: The complexity of modern vehicles requires specialized skills for repair, leading to higher labor costs. Additionally, there's often a need for specialized equipment and training to handle advanced vehicle technologies which was lacking in recent years.

4. Medical Cost Inflation: In cases involving bodily injury, the rising cost of healthcare has contributed to higher claim costs. This includes increased costs for medical treatments, rehabilitation, and long-term care.

5. Litigation and Legal Costs: There has been a trend towards increased litigation in auto insurance claims, driving up costs significantly. This includes legal fees and larger settlements or judgments due to an organized litigation practice across the country.

6. Economic Factors: Inflation and the increased costs of cars are encouraging drivers to drive their older cars for longer periods than ever before.

Navigating Challenges with AAIS

AAIS offers a comprehensive suite of products and services, including forms, rating information, and compliance guidance across the U.S., tailored to navigate these evolving challenges effectively.

1. Drive Ahead Webinar: Explore these challenges in detail and discover market-specific solutions with our expert-led webinar. Watch the webinar replay.

2. Personalized Assistance: Engage with our team for strategies that effectively address these challenging times. Talk to us today.

AAIS serves the property casualty insurance industry providing ‘best in class’ insurance forms, rules, and loss costs. AAIS is the only national not-for-profit advisory organization governed by its Member insurance companies. Whether you’re a national, multi-line insurer or an established regional carrier, a mutual insurance company or a focused monoline insurer, a Managing General Agent, or a start-up, our approach to building custom advisory solutions will deliver top-line and bottom-line benefits.