The auto insurance industry faces unique challenges in an era dominated by rapid technological advancements. Today's vehicles, equipped with sophisticated electronics and software, are redefining experiences for drivers, auto services, and insurance industry professionals. In a recent webinar, we explored various facets of auto insurance carriers' challenges.

ADAS

Navigating the Complexities of Automobile Technologies

Jan 3, 2024 / by Ash Naik posted in Technology, Tech News, Auto, Personal Auto, Data/Tech, ADAS

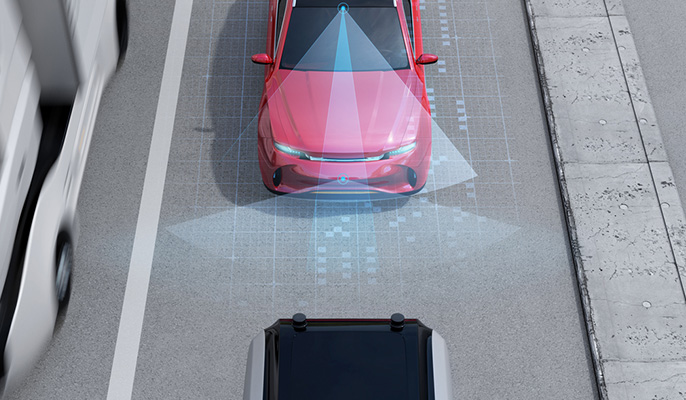

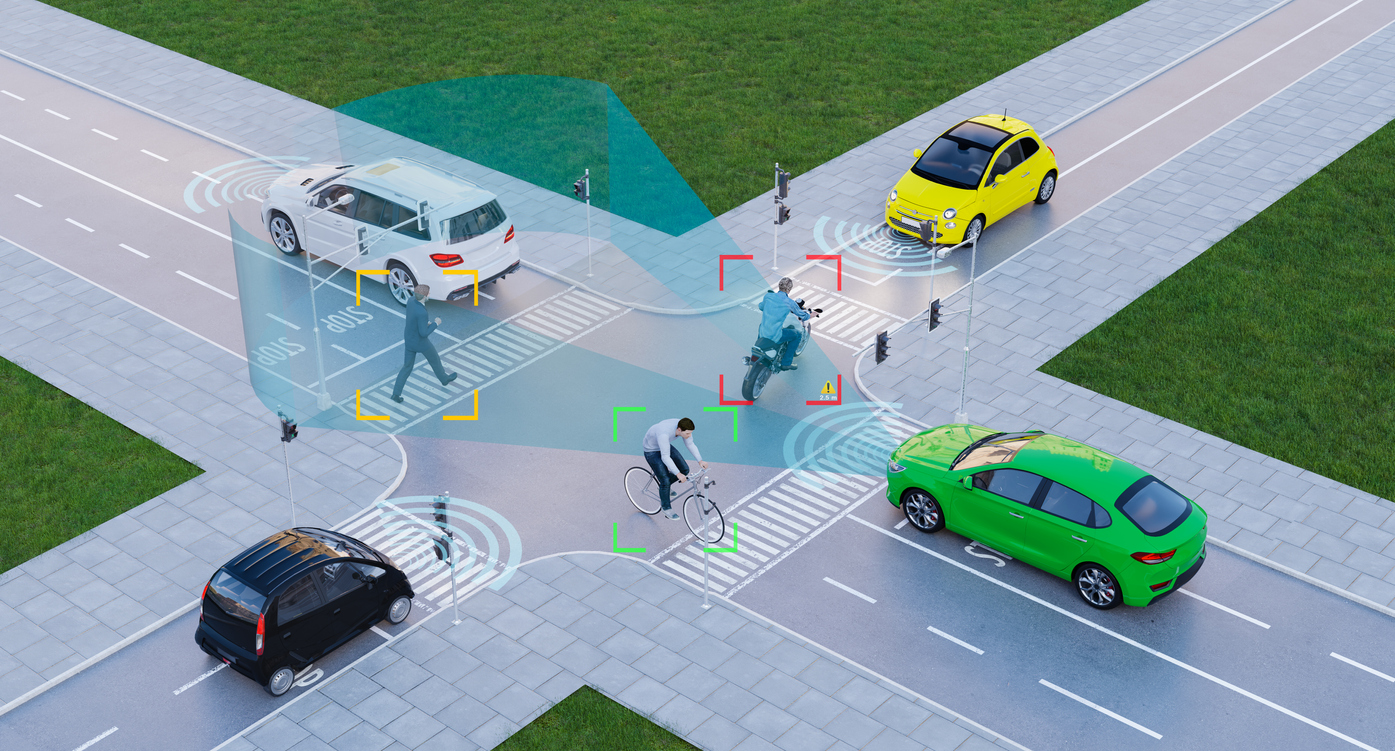

Advanced Driver Assistance Systems- A Game-Changer for Auto Insurance Ratemaking

Jul 12, 2023 / by Ash Naik posted in Technology, Auto, Personal Auto, ADAS

By utilizing the insights and capabilities of ADAS, carriers can enhance risk assessment accuracy, reduce accident frequency, and improve profitability. ADAS complements traditional rating variables like vehicle build, providing a dynamic layer of risk assessment and enhancing underwriting accuracy. Additionally, understanding the calibration status of ADAS systems is crucial to ensure optimal functionality and avoid potential hazards. As product managers in charge of auto insurance, it is essential to understand and leverage the power of ADAS to stay competitive in the evolving insurance landscape.