By utilizing the insights and capabilities of ADAS, carriers can enhance risk assessment accuracy, reduce accident frequency, and improve profitability. ADAS complements traditional rating variables like vehicle build, providing a dynamic layer of risk assessment and enhancing underwriting accuracy. Additionally, understanding the calibration status of ADAS systems is crucial to ensure optimal functionality and avoid potential hazards. As product managers in charge of auto insurance, it is essential to understand and leverage the power of ADAS to stay competitive in the evolving insurance landscape.

With the advent of Advanced Driver Assistance Systems (ADAS), an opportunity has emerged for insurance ratemaking. By leveraging information about these capabilities in the evaluation process, insurance carriers can unlock numerous benefits, enhancing risk assessment accuracy and profitability. Further, in the face of evolving regulatory environments, insurance carriers seek alternative rating variables to better segment and price risk while ensuring fairness and avoiding disadvantageous outcomes for certain groups. ADAS presents a promising solution in this context.

By incorporating ADAS data alongside other rating variables, carriers can gain a more comprehensive understanding of enhancements to driver behavior and vehicle safety. This approach enables carriers to tailor coverage and premiums more accurately, focusing on the specific risk profiles associated with individual policyholders. Unlike traditional rating variables such as credit scores, which have faced scrutiny due to potential bias and unfairness, ADAS offers an objective and technologically driven means of risk assessment. By leveraging ADAS data, carriers can enhance their risk segmentation capabilities and pricing policies more fairly while promoting safer driving behaviors.

Understanding ADAS

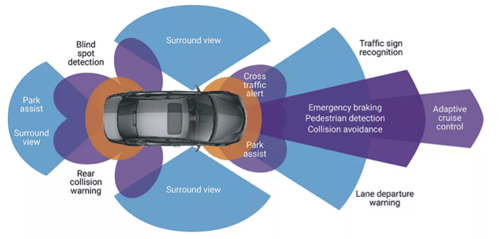

To begin, let's delve into what ADAS entails. ADAS refers to a suite of cutting-edge technologies integrated into modern vehicles to enhance driver safety and improve the overall driving experience. These systems employ various sensors, cameras, and algorithms to monitor the surrounding environment, detect potential hazards, and assist drivers in critical situations. Examples of ADAS features include adaptive cruise control, lane departure warning, automatic emergency braking, and blind-spot detection.

Today, many vehicles on the road are equipped with driver assistance technologies that can help save lives and prevent injuries. These technologies range from warning systems that alert drivers to potential risks, to systems that actively intervene to avoid crashes. Given the prevalence and the pace of evolution of these technologies, there is a growing need for risk-scoring models that can accurately assess the risk associated with different types of driver assistance technologies.

Enhanced Risk Assessment with ADAS

ADAS technologies complement traditional rating variables, such as vehicle build, in insurance ratemaking. While vehicle build characteristics like crash-test ratings and structural design provide important insights, ADAS offers a dynamic layer of risk assessment. These systems can actively intervene and assist drivers in potential collision scenarios, providing an additional layer of protection beyond the inherent safety features of the vehicle itself.

Over recent times, it has become apparent that the calibration status of ADAS is crucial to its functioning. Carriers not only need to know and use the built-in features but understand the calibration status of ADAS systems. Uncalibrated or improperly calibrated ADAS systems may be more hazardous than vehicles not equipped with ADAS. Insurers should ensure that policyholders' ADAS systems are regularly calibrated and functioning optimally. Several solutions including collaborations with manufacturers, repair shops, or technology service providers can help verify calibration status and educate policyholders about the importance of maintaining properly calibrated ADAS systems. Accurate calibration ensures that ADAS features function as intended, reducing the risk of false positives or negatives that could lead to accidents.

By leveraging ADAS data alongside traditional rating variables, insurance carriers can make more informed underwriting decisions. The combination of vehicle build characteristics and ADAS functionality provides a comprehensive view of driver safety. This integrated approach allows carriers to tailor coverage and premiums based on individual risk profiles, resulting in fairer pricing and reduced adverse selection.

With ADAS-enabled ratemaking, insurance carriers can better align premiums with risk, resulting in improved loss ratios and profitability. The utilization of ADAS systems incentivizes safer driving behaviors and helps mitigate the frequency and severity of accidents. Carriers can reward policyholders who actively use ADAS features with lower rates, encouraging adoption and reducing claim payouts.

In today's highly competitive insurance market, embracing ADAS for ratemaking can provide a significant competitive advantage. Carriers that integrate ADAS data into their rating models can attract safer drivers who recognize the benefits of ADAS and prefer insurers that reward their adoption. By establishing themselves as leaders in utilizing ADAS technology, carriers can build a positive brand image, increase customer retention, and expand their market share. The integration of ADAS into insurance ratemaking is a game-changer for auto insurance carriers.

Help Us Incorporate ADAS for Ratemaking

Are you a product manager in the auto insurance industry? We want to hear from you! Your insights and expertise are valuable in shaping the future of insurance ratemaking with ADAS. We are conducting a survey to evaluate the key features to consider when incorporating ADAS into insurance pricing models. By participating in this survey, you can contribute to the development of industry best practices and help insurance carriers stay ahead of the curve.

Click the link to participate in the survey and share your valuable input: Start Survey (5 mins)

Your responses will remain confidential and will be used solely for research purposes. We greatly appreciate your time and contribution in helping us understand the priorities and challenges associated with incorporating ADAS into insurance ratemaking. Together, we can drive innovation and create safer, more accurate, and fairer insurance solutions for policyholders.