As artificial intelligence (AI) continues to evolve in the P&C insurance industry, navigating regulatory trends has become increasingly critical to ensuring compliance, maintaining consumer trust, and fostering responsible innovation. In a recent AAIS webinar, industry experts discussed the evolving role of AI in the insurance sector, focusing on its regulatory trends and best practices for responsible adoption. Chris Aufenthie, Director of Regulatory Filings at AAIS, moderated the discussion with insights from Anthony Habayeb, Co-Founder and CEO of Monitaur, and Mary Block, Director of Insurance Regulation at the Vermont Department of Financial Regulation. Together, they explored key topics including trends in AI adoption, practical steps to align with the NAIC AI Bulletin, and strategies to ensure transparency and explainability for regulators and consumers.

AAIS Webinar Series

Advancing AI in Insurance: Navigating Regulatory Trends

Feb 13, 2025 / by AAIS posted in Regulatory/Compliance, Legislation & Regulation, AAIS Webinar Series, NAIC, Regulation, Compliance, AI, Artificial Intelligence

Making Flood Insurance Insurable and Profitable

Oct 8, 2024 / by AAIS posted in AAIS Webinar Series, AI, Flood Insurance, flood, catastrophe, reThought Flood

Our latest installment of the AAIS Webinar Series featuring AAIS Partner, reThought Flood, explored the innovative approaches to enhance flood insurance coverage and profitability while addressing the challenges faced by the market. Speakers highlighted the long-standing gap in flood protection and the urgent need for change, emphasizing the importance of education, mitigation, and accurate underwriting to make flood insurance sustainable and profitable. They also discussed how reThought Flood’s AI technology can more accurately predict risks. John Kadous, Vice President of Products at AAIS, led the discussion with Cory Isaacson, Chief Executive Officer of reThought Flood, and Derek Lynch, Chief Underwriting Officer of reThought Flood.

Navigating UBI in Auto Insurance: Insights from Driverscape 2024

Sep 5, 2024 / by Ash Naik posted in Issues & Trends, Telematics, Auto, Commercial Auto, Personal Auto, AAIS Webinar Series, auto insurance, UBI, Usage Based Insurance

The auto insurance landscape is evolving rapidly, driven by technological advancements and changing consumer preferences. The third annual AAIS Driverscape report provides valuable insights into these shifts, helping insurance carriers navigate the complexities of the modern market.

Leveraging Core Systems for Actionable Insights in Policy Claims

Aug 5, 2024 / by AAIS posted in Insights, Data & Technology, Data, AAIS Insights, AAIS Webinar Series, Data/Tech, OneShield

Our latest installment of the AAIS Webinar Series featuring AAIS Partner, OneShield, covered how carriers can effectively leverage and transform core system data into actionable insights to strengthen business decisions and policy claims management. Speakers explored the valuable data types within core systems such as policy, claims, and customer interactions, techniques for extracting and processing this data, and real-world examples demonstrating the impact of these insights. They also discussed the shift from static reports to dynamic data visualization and offered tips for identifying key insights critical for various stakeholders, including underwriters and claims managers. John Kadous, Vice President of Products at AAIS, and John Dunn, Vice President of Sales at OneShield led the discussion with Travis Mayfield, Reporting Product Manager at OneShield.

Accelerate Speed to Market with the AAIS S2M Toolkit

Jun 5, 2024 / by AAIS posted in Insurance Operations, AAIS Webinar Series, Policy Administration, Mind Maps, S2M Toolkit

The decision has been made. Your company’s leadership has determined now is the time to adopt a new product, to expand your company's offerings, and to do so quickly to take advantage of an opportunity in the market.

From Concept to Customer: GhostDraft Discusses the Need for Speed to Market in Insurance

Apr 17, 2024 / by AAIS posted in Technology, Insurtech, Regulatory/Compliance, AAIS Webinar Series, Data/Tech, Data Management, Compliance, GhostDraft

As part of the AAIS Webinar Series, AAIS hosted a virtual discussion on April 4, 2024, featuring AAIS Partner, GhostDraft. Moderated by John Kadous, AAIS Vice President of Products, the session explored the importance and challenges of speed to market. Joined by panelist Laurence White, Executive Vice President of Sales at GhostDraft, the two discussed modern technologies and innovations that can accelerate internal processes as well as how to balance speed and compliance. Kadous and White also offered successful strategies to improve operational efficiencies.

Leveraging Today's Underwriting Technologies to Modernize Homeowners Insurance with Chrp Technologies

Dec 18, 2023 / by AAIS posted in Personal Lines, Technology, Machine Learning/AI, Data & Technology, Insurtech, Homeowners, AAIS Webinar Series, Data/Tech, Underwriting, Artificial Intelligence, CHRP Technologies

As part of the AAIS Webinar Series, AAIS hosted a virtual discussion on December 7, 2023, featuring Chrp Technologies. Moderated by AAIS President & CEO Werner Kruck, the session explored the state of today’s home insurance market as well as the challenges and opportunities that lie ahead. Featured guest speakers Chin Ma, President of Chrp Technologies, and Brandi Wyrick, AVP of Experience at Orion180, reviewed how new and emerging technologies like Chrp can improve underwriting results and operational efficiencies. They also touched upon the role of artificial intelligence (AI) across the insurance space and how companies can leverage new capabilities to improve the customer experience.

AAIS Webinar ft. Davies: Hurricane Models – Creation, Usage, and Regulation

Jun 28, 2023 / by AAIS posted in AAIS Webinar Series, NAIC, Regulation, hurricanes, catastrophe, NatCats, Actuarial, Davies

As part of the AAIS Webinar Series, AAIS hosted a virtual presentation on June 13, 2023, featuring AAIS Partner, Davies. Moderated by AAIS Personal Lines Product Manager, Linda Jancik, the session explored how wind models are created, used, and regulated. Featured guest speakers, Greg Fanoe, Director & Consulting Actuary at Davies, Sandra Darby, Property & Casualty Division Actuary at the Maine Bureau of Insurance, and Shaveta Gupta, Catastrophe Risk & Modeling Actuary at the NAIC, discussed how this data is gathered from inside the storm, why it’s collected, and how it is used by insurance carriers to price policies. The panel also analyzed hurricane models from the regulation side, explaining how regulators use this data to develop legislation to further protect consumers and ensure a healthy market.

Making Wildfire Mitigation Meaningful: AAIS Addresses California’s Mandatory Wildfire Mitigation Credits Regulation

Jun 14, 2023 / by AAIS posted in Personal Lines, AAIS Webinar Series, Regulation, wildfire, Actuarial, California

As part of the AAIS Webinar Series, AAIS hosted a virtual presentation on June 6, 2023, regarding California’s Mandatory Wildfire Mitigation Credits regulation. AAIS industry leaders, Robin Westcott, Vice President of Government Affairs, Legal & Compliance/General Counsel, Linda Jancik, Product Manager of Personal Lines, Mike Payne, Chief Pricing Actuary, and Matt Hinds-Aldrich, Senior Risk Strategy Lead, presented an overview of how the regulation was addressed across impacted programs from both a product and actuarial perspective. The panel also focused on the consumer notice requirement, highlighting how notice design can help motivate consumer action to complete wildfire mitigations on their properties. Panelists shared a notice template developed in response to this regulation that can easily be used and adapted in response to this regulation.

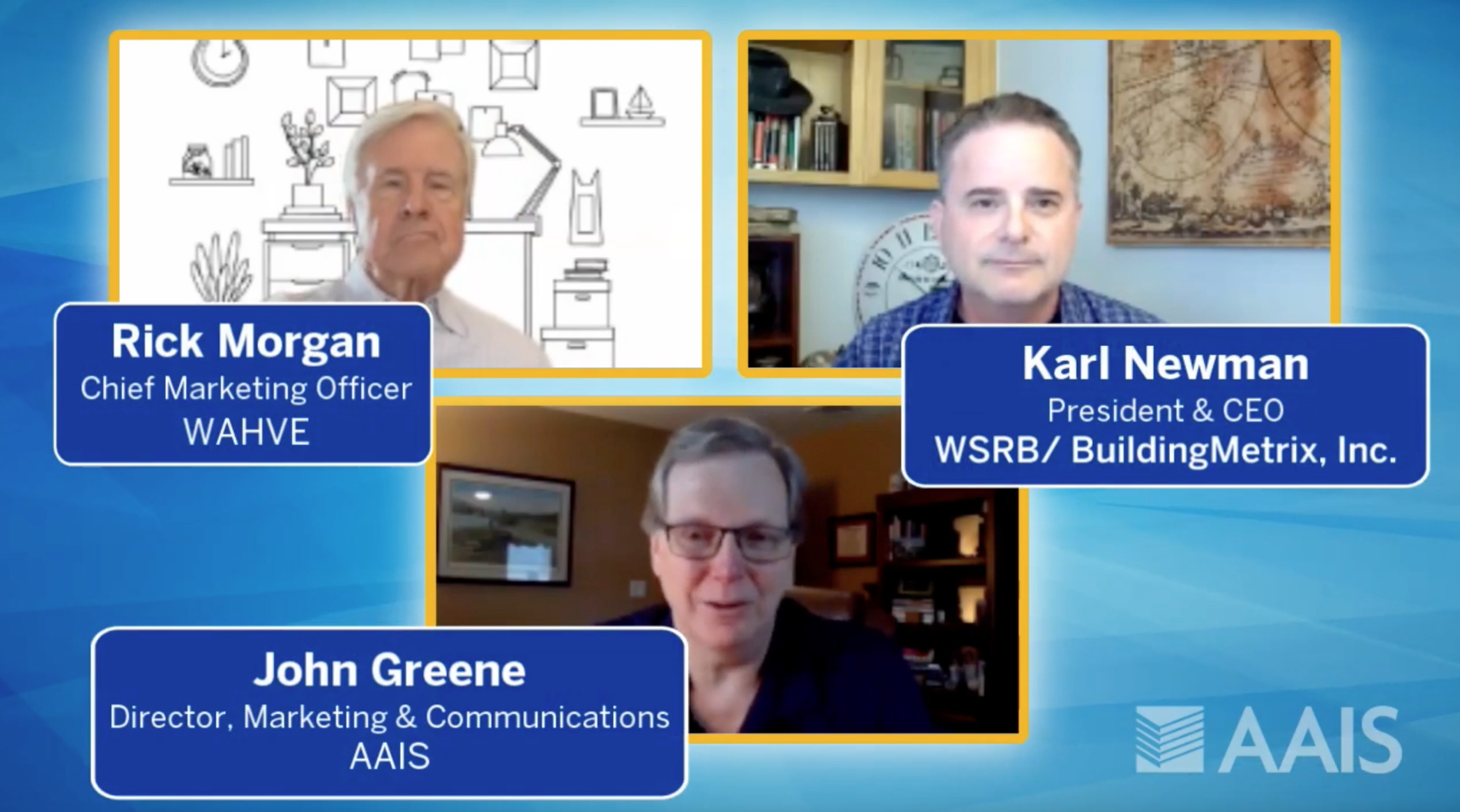

AAIS Webinar ft. WSRB & WAHVE: Explore Acquiring Talent & Leading a Team in a Virtual World

May 24, 2023 / by AAIS posted in Working in Insurance, Remote Work, AAIS Webinar Series, WAHVE, WSRB

Today's work environment has shifted significantly, and employers are faced with a pressing need to offer both remote and hybrid working styles to accommodate workforce needs as well as attract top talent. As part of the AAIS Webinar Series, AAIS hosted a virtual presentation on May 4, 2023, featuring AAIS Partners WSRB/BuidingMetrix, Inc. and WAHVE. Moderated by AAIS Director of Marketing and Communications, John Greene, the presentation explored what it takes to acquire talent as well as manage them successfully within these new working parameters. Panelists Karl Newman, CEO of WSRB/BuildingMetrix, Inc., and Rick Morgan, Chief Marketing Officer of WAHVE, discussed what type of working environment current job seekers are looking for, how employers can recruit talent that fits this model, onboarding best practices, and ways to lead and motivate a virtual team successfully.