Uninsured drivers cost carriers upwards of $13 billion a year in losses. Add on $84 per car per year and consumer affordability for auto insurance is strained. The difficulty in resolving this issue has been the limitations and costs of technology, but that is no longer the case. Join us in building a community across insurance and mobility to solve this problem.

Driving legally is subject to three elements- license, registration, and insurance. If a driver is old enough, passes the required tests, follows the rules of the road, and does not become legally, mentally, and/or physically unfit to drive, the license cannot be revoked. Vehicle registrations are used to determine vehicle ownership and permit the legal operation of the vehicle on public roads. Insurance is mandatory in all 50 states to cover liability losses both bodily injury and property damage during vehicle operations on public roads.

Although these requirements are necessary, the enforcement of the existence of all three items on legal drivers varies significantly from state to state. On one end of the spectrum, state law requires all three but does not make any effort at enforcement; while on the other end, registration to vehicles is revoked as insurance expires.

Costs of Illegal Drivers

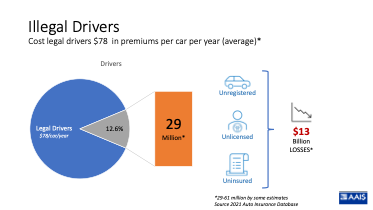

Based on the auto insurance database report published by the National Association of Insurance Commissioners (NAIC), the metrics from III, and the Department of Transportation, there are between 29 and 61 million illegal drivers on public roads who are not meeting one of the three requirements to drive. These drivers cost insurance carriers over $13 billion in losses, annually trending upwards, with a majority falling on physical injury.

Auto policyholders also bear the cost of uninsured drivers. III estimates legal drivers pay about $78 per car per year in premiums to cover the losses that they might incur due to uninsured drivers. This is being viewed as an insurance affordability problem, especially for the underprivileged population that finds mobility essential.

State-Wide Distribution

While the population of uninsured drivers stands around 12%, this is not evenly distributed across the top 10 states. Uninsured drivers contribute to over 17 million illegal drivers on the road. On the vehicle side, over 14 million uninsured vehicles were causing just under $4 billion in losses in 2019 per the Insurance Research Council at III.

The largest population of uninsured drivers operates in California. Over 4.5 million drivers incurred losses of over $1.3 billion in 2018, with 96% of those losses falling under bodily injury. While these numbers might appear large, they are overshadowed by the average claim size in Florida (the second largest uninsured driver population state) by 22%. Mississippi tops the list of states with the highest percentage of uninsured drivers at 29.4%. New Jersey has the smallest uninsured driver population of 3.1%. This points to the extremely large variance in the challenges each state faces on the problem.

Uninsured Driver Solution

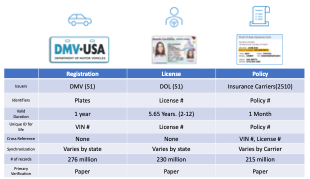

Solving the uninsured driver problem is not easy. The solution needs standards-based, secure, and trustworthy data sharing across 2,612 organizations that hold over 721 million records across 51 jurisdictions in the U.S. for personal auto. These records have valid durations varying from one month to 12 years with revocation possible at any time for license or policy information. Further enforcement of the laws is distributed over 18,036 agencies across the country. A solution to work cost-effectively and efficiently requires a level of decentralization that has not existed until now.

Solving the uninsured driver problem is not easy. The solution needs standards-based, secure, and trustworthy data sharing across 2,612 organizations that hold over 721 million records across 51 jurisdictions in the U.S. for personal auto. These records have valid durations varying from one month to 12 years with revocation possible at any time for license or policy information. Further enforcement of the laws is distributed over 18,036 agencies across the country. A solution to work cost-effectively and efficiently requires a level of decentralization that has not existed until now.

Collaborative, open-source, and standards-based solutions are keys to overcoming the challenges placed by data privacy and protection laws that vary by state. Starting with accurate, verifiable, and secure credentials for drivers, vehicles, and policies while maintaining the confidentiality of the carriers is key to solving this challenge.

Blockchain networks can be ideally suited to solve this problem while tackling other challenges facing the transportation industry today. In addition to solving this quantifiable problem, this solution has the capability of enabling digital identification and verification with added enhancements in security.