Cannabis is a multi-billion-dollar market that continues to be underserved by the insurance industry. While the majority of states and the District of Columbia have legalized cannabis in one form or another, less than 30 insurers are participating in the marketplace nationwide. As the number of states moving toward legalization rises, the number of cannabis related businesses (CRBs) multiplies, and public acceptance of legalization increases, it is imperative that the insurance industry understand and normalize cannabis coverage.

AAIS News & Views (2)

Cannabis Coverage…Worth the Risk

Nov 15, 2021 / by Joe Jonas posted in Community, Issues & Trends, Regulatory/Compliance, Cannabis, P&C Insurers, Commercial Lines, Legislation & Regulation, AAIS News & Views, AAIS Insights, Insurance Line of Business

Members Influence Inland Marine Upgrades

Nov 9, 2021 / by Bob Guevara posted in Issues & Trends, Inland Marine, New/Emerging Risks, P&C Insurers, AAIS News & Views, AAIS Insights, Insurance Line of Business, Builders Risk

AAIS continues to evolve its offerings in the Inland Marine (IM) space, where it has long been an industry leader. Our most recent product update includes a Defective Design and Construction Coverage endorsement to go with a Builders’ Risk policy. This enhancement is a result of input and engagement by Members who were looking for something similar to the LEG 3 (London Engineering Group) endorsement. Its intent is to narrow a policy’s automatic exclusion, providing broader coverage for materials, workmanship, and faulty design during construction, making it easier for insureds to be made whole. The Defective Design and Construction Coverage endorsement is available for large and mid-size construction projects when traditionally, it was available only for large projects.

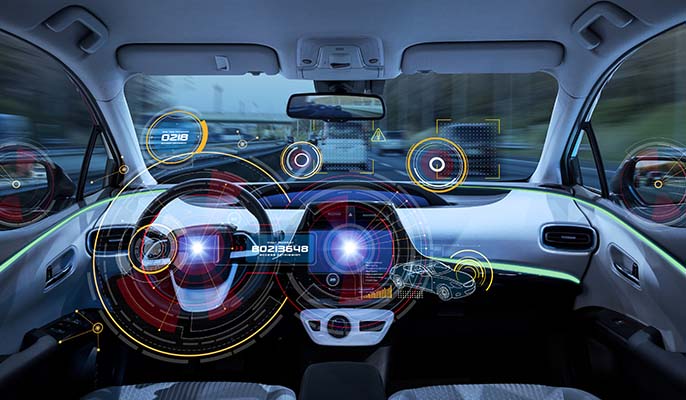

Keeping Pace with the Evolving Auto Industry

Nov 2, 2021 / by Ash Naik posted in Community, Technology, Issues & Trends, Data & Technology, Tech News, Telematics, P&C Insurers, Auto, Commercial Auto, AAIS News & Views, AAIS Insights, Personal Auto, Data/Tech, Insurance Line of Business

A Fast-Moving Auto Industry Presents Challenges and Opportunities

The automotive industry transformation continues to have significant repercussions in the insurance industry. With improving sophistication in car technology, telematics, and consumer behaviors, insurance carriers face new and unprecedented challenges spanning the entire lifecycle of the policy from research to claims. Still, personal and commercial auto insurance remain the industry bellwether as the largest product lines accounting for more than $300 billion in annual premiums.

Concerns and Opportunities Related to Pandemic Coverage

Aug 3, 2021 / by Nicole Milos posted in Community, Issues & Trends, COVID-19, Regulatory/Compliance, New/Emerging Risks, Legislation & Regulation, AAIS News & Views, AAIS Insights, AAIS Webinar Series, pandemic, Business Interruption, AAIS Views, GLC

While the U.S. economy slowly returns to normal following the COVID-19 pandemic, the insurance industry continues to grapple with business interruption claims, court battles and the future of pandemic-related insurance. In Part II of our two-part Advisory Report, Nicole Milos, Assistant Counsel at AAIS, explains the systemic risk global pandemics pose to the insurance industry and how we’re leveraging data gathered during the pandemic to meet customer demand for future pandemic-type coverage.

Exploring Agile: Software Development for Streamlining Success

Jul 8, 2020 / by Travis Rigas posted in Community, Issues & Trends, Working in Insurance, P&C Insurers, Industry, Business, AAIS News & Views, AAIS Insights, Rally, Agile, Executive, AAIS Views

At AAIS, we’re continually refining our best-in-class products and services to better meet the needs of our Members in a quickly changing industry. In January of 2013, we recognized the need to improve our work processes in order to respond to growing market demand. That’s when AAIS adopted Agile as a new approach to project management.