BluePond.AI will offer AAIS Members innovative solutions for the P&C insurance industry, leveraging their Gen-AI-based CoPilot platform.

BluePond.AI Joins AAIS Partner Program, Offering Members Greater Efficiency and Regulatory Compliance Using Artificial Intelligence

Mar 14, 2024 / by AAIS posted in Press Release, BluePond.AI

Applying AI to Solve the Talent Crunch and How to Avoid Its Pitfalls with WAHVE CEO

Mar 13, 2024 / by AAIS posted in Machine Learning/AI, Remote Work, WAHVE, AI, Artificial Intelligence, talent gap, Advisory Report

For this Advisory Report, AAIS spoke with Sharon Emek, Ph.D., CIC, CEO of AAIS Partner, WAHVE, a unique contract staffing talent solution serving the insurance industry, for a two-part series on how to solve the talent crunch and retain quality talent in the insurance industry. In part one, Emek addressed the state of the talent gap in the insurance industry, searching for candidates with AI, advice for hiring managers, and more.

Defining the Future of Insurance Through The Power of Community

Mar 6, 2024 / by John Kadous posted in Community, AAIS Insights, membership, Insurance Advisory, All Access Membership

Growth opportunities in the insurance industry can be fleeting. When insurers see potential, they need to move fast, take advantage of every opportunity, and capture markets quickly. Insurers succeed when they deliver optimal value to policyholders with coverage that addresses their needs clearly and effectively.

Mind Maps: The Organization Tool Transforming the AAIS Auto Program & Insurance Industry Alike

Jan 31, 2024 / by Ash Naik posted in Issues & Trends, Insurance Operations, Auto, Personal Auto, auto insurance, AAIS Auto Program, Mind Maps

Updating or creating new insurance products is generally expected to be a long and expensive endeavor for insurance carriers. Most insurance products are made with insurance experts in mind, which can be hard for technology teams to understand. Having a product analyst is essential to make these complex ideas clear and ready for implementation.

Commercial Property Preparedness: Bracing for Changing Risks

Jan 24, 2024 / by Liza Petrie posted in Commercial Lines, Data, Underwriting, reinsurance, OneShield, risk management

A staggering number of billion-dollar weather and climate disaster events have rocked the United States in 2023. The National Oceanic and Atmospheric Administration reported in early September that 23 events with losses exceeding $1 billion each had hit the country last year. That marked the most in a calendar year in more than four decades of record-keeping.

Catastrophes, higher building costs, and inflation are all impacting commercial underwriting performance and insurer profitability. Proper portfolio valuation is becoming exponentially important as the reinsurance market tightens. So, how can insurance companies better manage their books of business now and into an uncertain future? The answer is rooted in addressing valuation issues by tapping third-party vendors. The answer is tied to partnering with a robust digital platform provider. The answer is collaboration.

In the past, it was easy for insurers to dismiss data as untrustworthy because they didn’t want to invest in it. Now, third-party vendors present necessary advances that help to paint the bigger picture. Platforms like OneShield are the glue that brings these tools together. And, not just for underwriting purposes. In the commercial lines business, customers are generally good risk management partners. OneShield and its customers have seen tremendous engagement with agents and policyholders who want to proactively manage risk. Failing to enable that is a missed opportunity.

SimpleSolve Joins AAIS Partner Program, Providing Members with Access to an Innovative Insurance Administration Platform

Jan 16, 2024 / by AAIS posted in Insurtech, Press Release, SimpleSolve

SimpleSolve offers a fully re-engineered and fully integrated P&C insurance platform based on the latest technology that delivers a strong ROI for insurance carriers.

GhostDraft Joins AAIS Partner Program, Offering Streamlined Form Solutions for Members

Jan 8, 2024 / by AAIS posted in Insurtech, insurance automation, Press Release, GhostDraft

GhostDraft will offer AAIS Members the ability to streamline current processes and increase speed to market.

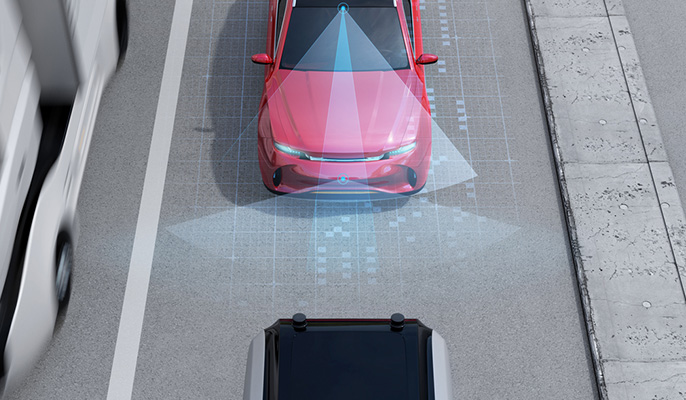

Navigating the Complexities of Automobile Technologies

Jan 3, 2024 / by Ash Naik posted in Technology, Tech News, Auto, Personal Auto, Data/Tech, ADAS

The auto insurance industry faces unique challenges in an era dominated by rapid technological advancements. Today's vehicles, equipped with sophisticated electronics and software, are redefining experiences for drivers, auto services, and insurance industry professionals. In a recent webinar, we explored various facets of auto insurance carriers' challenges.

Leveraging Today's Underwriting Technologies to Modernize Homeowners Insurance with Chrp Technologies

Dec 18, 2023 / by AAIS posted in Personal Lines, Technology, Machine Learning/AI, Data & Technology, Insurtech, Homeowners, AAIS Webinar Series, Data/Tech, Underwriting, Artificial Intelligence, CHRP Technologies

As part of the AAIS Webinar Series, AAIS hosted a virtual discussion on December 7, 2023, featuring Chrp Technologies. Moderated by AAIS President & CEO Werner Kruck, the session explored the state of today’s home insurance market as well as the challenges and opportunities that lie ahead. Featured guest speakers Chin Ma, President of Chrp Technologies, and Brandi Wyrick, AVP of Experience at Orion180, reviewed how new and emerging technologies like Chrp can improve underwriting results and operational efficiencies. They also touched upon the role of artificial intelligence (AI) across the insurance space and how companies can leverage new capabilities to improve the customer experience.

Redefining Mobility & Risks of Battery Fires: Findings from an FDNY Symposium

Nov 2, 2023 / by Matt Hinds-Aldrich posted in Technology, Issues & Trends, New/Emerging Risks, Fire, AAIS Insights, Risk, FLAMES, Battery Fires

We recently discussed the rapid proliferation of batteries in modern homes and businesses and the more worrying proliferation of fires associated with those batteries on AAIS Views. On October 12, 2023, the Fire Department for the City of New York (FDNY) hosted a one-day symposium titled, “A Conversation with the Insurance Industry About Lithium-Ion Batteries.” The intent of the symposium was to share the scope of the problem, the current state-of-the-art in mitigating these types of incidents, and a clarion call for insurers to join the fight in addressing this scourge.