For this Advisory Report, AAIS spoke with its Vice President of Products, John Kadous. He discussed current issues for insurance carriers, opportunities in the MGA segment, how AAIS is supporting its Members, and more.

AAIS Vice President of Products Reveals Organizational Opportunities in the MGA Segment & Member Support Initiatives

Oct 17, 2023 / by AAIS posted in Technology, Insurtech, membership, Data/Tech, Advisory Report, MGA

AAIS President & CEO’s View on Addressing Market Challenges with Data & His Vision for AAIS and Its Members

Oct 10, 2023 / by AAIS posted in Data & Technology, Data, AAIS Insights, membership, Data/Tech, Insurance Market, Advisory Report

For this Advisory Report, AAIS spoke with its President and CEO, Werner Kruck. He discussed the biggest market challenges and how to address them with data, a better approach to the “data problem,” how AAIS is supporting its Members, and his outlook on AAIS moving forward.

Tapoly CEO Explains What Insurers Should Know When It Comes to the Gig Economy

Aug 9, 2023 / by Janthana Kaenprakhamroy posted in Insights, Issues & Trends, New/Emerging Risks, AAIS Insights, Economy, Tapoly, Gig Economy

For the third part of our blog series featuring Tapoly, the digital provider of flexible insurance products and insurance technology solutions, CEO Janthana Kaenprakhamroy offers insight to insurers on the gig economy market. Kaenprakhamroy breaks down the gig economy, how it affects insurers, and solutions for small businesses to navigate this market system.

Home Is Where the Battery Is

Jul 17, 2023 / by Matt Hinds-Aldrich posted in Personal Lines, Technology, Issues & Trends, Insurance News/Current Events, Homeowners, New/Emerging Risks, Fire, AAIS Insights, Risk, AAIS FLAMES

“Check out my new drone. The camera and range are exceptional!”

“I’ve been getting out of the house more than ever with this new e-bike, have you considered getting one?”

“Now that my solar array is complete, and I’ve connected the new 3000-watt home battery backup, I’m ready to go off-grid.”

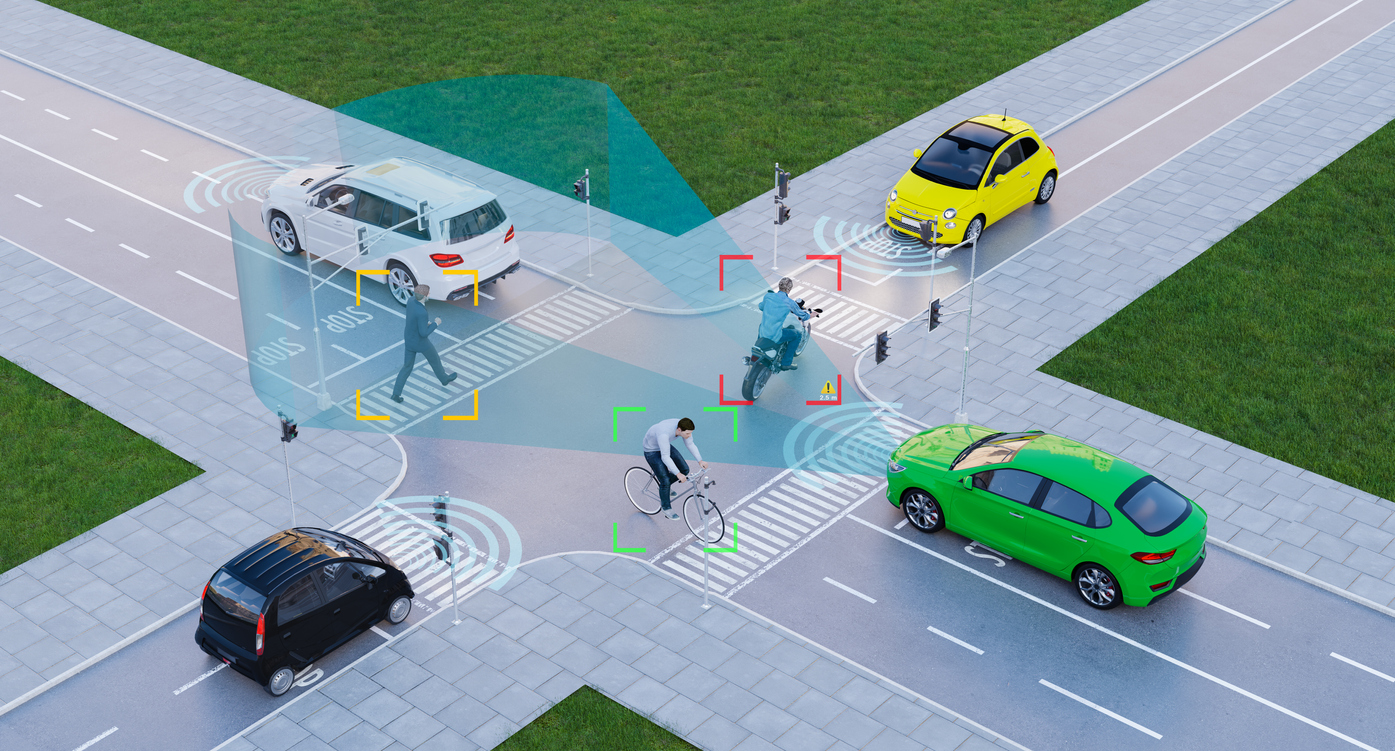

Advanced Driver Assistance Systems- A Game-Changer for Auto Insurance Ratemaking

Jul 12, 2023 / by Ash Naik posted in Technology, Auto, Personal Auto, ADAS

By utilizing the insights and capabilities of ADAS, carriers can enhance risk assessment accuracy, reduce accident frequency, and improve profitability. ADAS complements traditional rating variables like vehicle build, providing a dynamic layer of risk assessment and enhancing underwriting accuracy. Additionally, understanding the calibration status of ADAS systems is crucial to ensure optimal functionality and avoid potential hazards. As product managers in charge of auto insurance, it is essential to understand and leverage the power of ADAS to stay competitive in the evolving insurance landscape.

AAIS Webinar ft. Davies: Hurricane Models – Creation, Usage, and Regulation

Jun 28, 2023 / by AAIS posted in AAIS Webinar Series, NAIC, Regulation, hurricanes, catastrophe, NatCats, Actuarial, Davies

As part of the AAIS Webinar Series, AAIS hosted a virtual presentation on June 13, 2023, featuring AAIS Partner, Davies. Moderated by AAIS Personal Lines Product Manager, Linda Jancik, the session explored how wind models are created, used, and regulated. Featured guest speakers, Greg Fanoe, Director & Consulting Actuary at Davies, Sandra Darby, Property & Casualty Division Actuary at the Maine Bureau of Insurance, and Shaveta Gupta, Catastrophe Risk & Modeling Actuary at the NAIC, discussed how this data is gathered from inside the storm, why it’s collected, and how it is used by insurance carriers to price policies. The panel also analyzed hurricane models from the regulation side, explaining how regulators use this data to develop legislation to further protect consumers and ensure a healthy market.

AAIS Announces Werner E. Kruck as President and CEO

Jun 21, 2023 / by AAIS posted in Press Release

LISLE, IL., June 21, 2023 -- The Board of Directors of American Association of Insurance Services (AAIS) is pleased to announce the selection of Werner E. Kruck as President and Chief Executive Officer, effective June 26, 2023. Mr. Kruck has spent his entire career in leading roles within the insurance industry and has served on the AAIS Board of Directors since 2018.

Making Wildfire Mitigation Meaningful: AAIS Addresses California’s Mandatory Wildfire Mitigation Credits Regulation

Jun 14, 2023 / by AAIS posted in Personal Lines, AAIS Webinar Series, Regulation, wildfire, Actuarial, California

As part of the AAIS Webinar Series, AAIS hosted a virtual presentation on June 6, 2023, regarding California’s Mandatory Wildfire Mitigation Credits regulation. AAIS industry leaders, Robin Westcott, Vice President of Government Affairs, Legal & Compliance/General Counsel, Linda Jancik, Product Manager of Personal Lines, Mike Payne, Chief Pricing Actuary, and Matt Hinds-Aldrich, Senior Risk Strategy Lead, presented an overview of how the regulation was addressed across impacted programs from both a product and actuarial perspective. The panel also focused on the consumer notice requirement, highlighting how notice design can help motivate consumer action to complete wildfire mitigations on their properties. Panelists shared a notice template developed in response to this regulation that can easily be used and adapted in response to this regulation.

Data Calls and Stat Reporting: Outdated Methods Causing Issues for Auto Insurance Carriers

Jun 1, 2023 / by Ash Naik posted in openIDL, Auto, Personal Auto, auto insurance, AAIS Auto Program

Data calls and stat reporting continue to remain a slow, tedious, and error-prone overhead to most carriers. Recent advances in technology have demonstrated that streamlining and automating this can provide benefits beyond meeting regulatory requirements. Join us in building a community that puts data to work beyond staying in compliance.

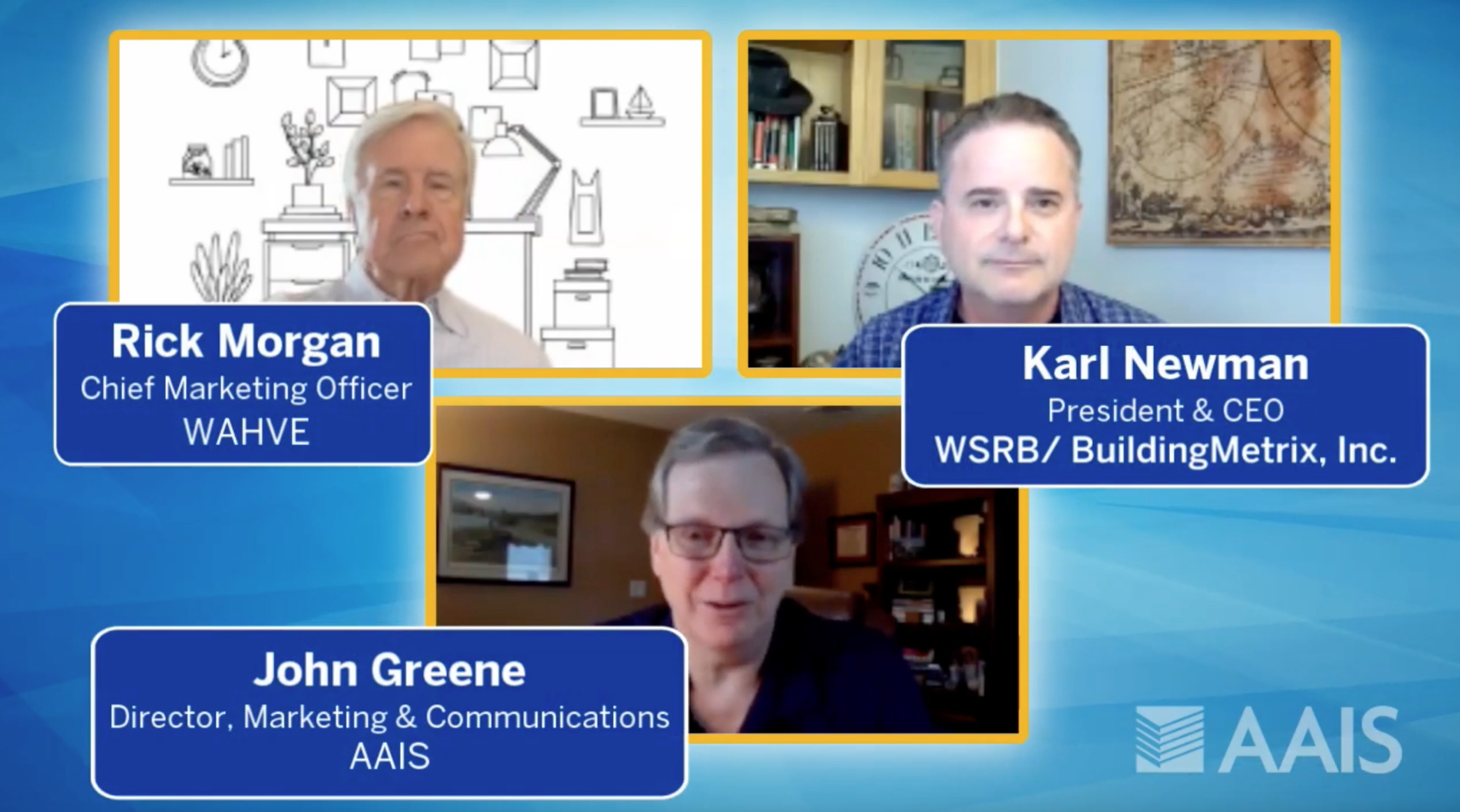

AAIS Webinar ft. WSRB & WAHVE: Explore Acquiring Talent & Leading a Team in a Virtual World

May 24, 2023 / by AAIS posted in Working in Insurance, Remote Work, AAIS Webinar Series, WAHVE, WSRB

Today's work environment has shifted significantly, and employers are faced with a pressing need to offer both remote and hybrid working styles to accommodate workforce needs as well as attract top talent. As part of the AAIS Webinar Series, AAIS hosted a virtual presentation on May 4, 2023, featuring AAIS Partners WSRB/BuidingMetrix, Inc. and WAHVE. Moderated by AAIS Director of Marketing and Communications, John Greene, the presentation explored what it takes to acquire talent as well as manage them successfully within these new working parameters. Panelists Karl Newman, CEO of WSRB/BuildingMetrix, Inc., and Rick Morgan, Chief Marketing Officer of WAHVE, discussed what type of working environment current job seekers are looking for, how employers can recruit talent that fits this model, onboarding best practices, and ways to lead and motivate a virtual team successfully.