Today, there is a lot of buzz surrounding generative artificial intelligence (GenAI) and its potentially significant implications for the insurance industry. The use of GenAI in insurance is taking a large step forward, leading the paradigm shift in AI and machine learning (ML) due to its efficient and innovative features. In the dynamic realm of insurance, burdened by cumbersome manual processes, traditional AI solutions are limited. GenAI transcends these limitations, offering transformative solutions to streamline insurance workflows and propel the industry forward.

Technology (2)

The Art of the Possible with GenAI in Insurance

May 23, 2024 / by Sachin Kachare posted in Technology, Data & Technology, P&C Insurers, Data/Tech, Underwriting, AI, Artificial Intelligence, Brokers, Insurance Agents, MGA, BluePond.AI

From Concept to Customer: GhostDraft Discusses the Need for Speed to Market in Insurance

Apr 17, 2024 / by AAIS posted in Technology, Insurtech, Regulatory/Compliance, AAIS Webinar Series, Data/Tech, Data Management, Compliance, GhostDraft

As part of the AAIS Webinar Series, AAIS hosted a virtual discussion on April 4, 2024, featuring AAIS Partner, GhostDraft. Moderated by John Kadous, AAIS Vice President of Products, the session explored the importance and challenges of speed to market. Joined by panelist Laurence White, Executive Vice President of Sales at GhostDraft, the two discussed modern technologies and innovations that can accelerate internal processes as well as how to balance speed and compliance. Kadous and White also offered successful strategies to improve operational efficiencies.

IMUA Vice President Shares Inland Marine Market Trends, Climate Change Impacts, and Tech Innovations Ahead of Annual Meeting

Apr 10, 2024 / by AAIS posted in Technology, Inland Marine, Climate Change, Blockchain, IMUA, Artificial Intelligence, Inflation, Analytics

AAIS spoke with Lillian Colson, Vice President and Secretary of Inland Marine Underwriters Association (IMUA), the national association for the commercial inland marine insurance industry in the U.S. Colson discussed trends shaping today’s inland marine market, effects of climate change on inland marine, the use of data and technology tools, and what’s new at IMUA, including its upcoming Annual Meeting.

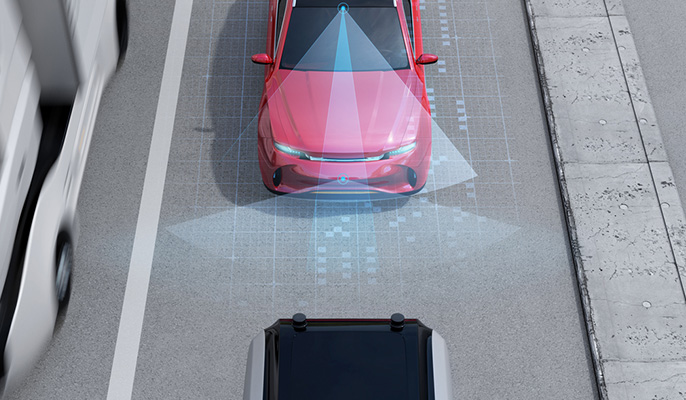

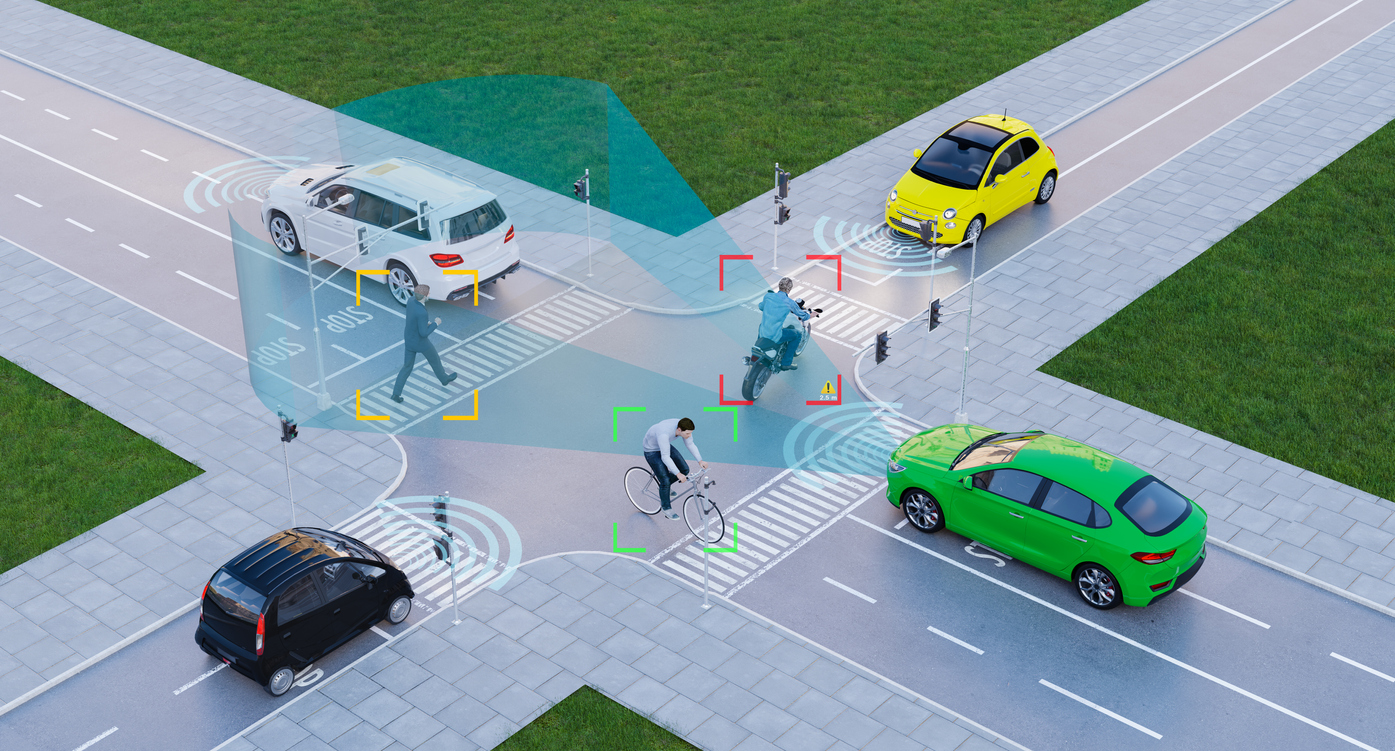

Navigating the Complexities of Automobile Technologies

Jan 3, 2024 / by Ash Naik posted in Technology, Tech News, Auto, Personal Auto, Data/Tech, ADAS

The auto insurance industry faces unique challenges in an era dominated by rapid technological advancements. Today's vehicles, equipped with sophisticated electronics and software, are redefining experiences for drivers, auto services, and insurance industry professionals. In a recent webinar, we explored various facets of auto insurance carriers' challenges.

Leveraging Today's Underwriting Technologies to Modernize Homeowners Insurance with Chrp Technologies

Dec 18, 2023 / by AAIS posted in Personal Lines, Technology, Machine Learning/AI, Data & Technology, Insurtech, Homeowners, AAIS Webinar Series, Data/Tech, Underwriting, Artificial Intelligence, CHRP Technologies

As part of the AAIS Webinar Series, AAIS hosted a virtual discussion on December 7, 2023, featuring Chrp Technologies. Moderated by AAIS President & CEO Werner Kruck, the session explored the state of today’s home insurance market as well as the challenges and opportunities that lie ahead. Featured guest speakers Chin Ma, President of Chrp Technologies, and Brandi Wyrick, AVP of Experience at Orion180, reviewed how new and emerging technologies like Chrp can improve underwriting results and operational efficiencies. They also touched upon the role of artificial intelligence (AI) across the insurance space and how companies can leverage new capabilities to improve the customer experience.

Redefining Mobility & Risks of Battery Fires: Findings from an FDNY Symposium

Nov 2, 2023 / by Matt Hinds-Aldrich posted in Technology, Issues & Trends, New/Emerging Risks, Fire, AAIS Insights, Risk, FLAMES, Battery Fires

We recently discussed the rapid proliferation of batteries in modern homes and businesses and the more worrying proliferation of fires associated with those batteries on AAIS Views. On October 12, 2023, the Fire Department for the City of New York (FDNY) hosted a one-day symposium titled, “A Conversation with the Insurance Industry About Lithium-Ion Batteries.” The intent of the symposium was to share the scope of the problem, the current state-of-the-art in mitigating these types of incidents, and a clarion call for insurers to join the fight in addressing this scourge.

AAIS Vice President of Products Reveals Organizational Opportunities in the MGA Segment & Member Support Initiatives

Oct 17, 2023 / by AAIS posted in Technology, Insurtech, membership, Data/Tech, Advisory Report, MGA

For this Advisory Report, AAIS spoke with its Vice President of Products, John Kadous. He discussed current issues for insurance carriers, opportunities in the MGA segment, how AAIS is supporting its Members, and more.

Home Is Where the Battery Is

Jul 17, 2023 / by Matt Hinds-Aldrich posted in Personal Lines, Technology, Issues & Trends, Insurance News/Current Events, Homeowners, New/Emerging Risks, Fire, AAIS Insights, Risk, AAIS FLAMES

“Check out my new drone. The camera and range are exceptional!”

“I’ve been getting out of the house more than ever with this new e-bike, have you considered getting one?”

“Now that my solar array is complete, and I’ve connected the new 3000-watt home battery backup, I’m ready to go off-grid.”

Advanced Driver Assistance Systems- A Game-Changer for Auto Insurance Ratemaking

Jul 12, 2023 / by Ash Naik posted in Technology, Auto, Personal Auto, ADAS

By utilizing the insights and capabilities of ADAS, carriers can enhance risk assessment accuracy, reduce accident frequency, and improve profitability. ADAS complements traditional rating variables like vehicle build, providing a dynamic layer of risk assessment and enhancing underwriting accuracy. Additionally, understanding the calibration status of ADAS systems is crucial to ensure optimal functionality and avoid potential hazards. As product managers in charge of auto insurance, it is essential to understand and leverage the power of ADAS to stay competitive in the evolving insurance landscape.

Tapoly CEO Shares How Insurance Companies Can Achieve Efficiency Utilizing Automated Technology

May 18, 2023 / by Janthana Kaenprakhamroy posted in Insights, Technology, Issues & Trends, Data & Technology, Insurtech, Blockchain, AAIS News & Views, AAIS Insights, Data/Tech, Artificial Intelligence, Machine Learning, Analytics, Tapoly

For the second part of our blog series featuring Tapoly, the digital provider of flexible insurance products and insurance technology solutions, CEO Janthana Kaenprakhamroy gives insight into how insurance companies can utilize automated technology to achieve efficiency. Kaenprakhamroy delves into how this technology can be utilized, where to apply these solutions within a company, obstacles insurers may face, and how SaaS solutions can help.