The farm industry continues to transform. While smaller family farming operations maintain a strong presence and make up a large percentage of the market, we’re seeing growth of large commercial farms that include a variety of operations and layered revenue streams. It is an ultra-competitive market with each company searching for an edge over their competitors.

Issues & Trends (3)

Update from The Farm…Farmowners Product Expanding

Nov 30, 2021 / by Hope King posted in Technology, Issues & Trends, Data & Technology, Robotics/Drones, Tech News, Farm & Ag, P&C Insurers, Farming, AAIS News & Views, AAIS Insights, Data/Tech, Insurance Line of Business, Farmowners (FO)

Cannabis Coverage…Worth the Risk

Nov 15, 2021 / by Joe Jonas posted in Community, Issues & Trends, Regulatory/Compliance, Cannabis, P&C Insurers, Commercial Lines, Legislation & Regulation, AAIS News & Views, AAIS Insights, Insurance Line of Business

Cannabis is a multi-billion-dollar market that continues to be underserved by the insurance industry. While the majority of states and the District of Columbia have legalized cannabis in one form or another, less than 30 insurers are participating in the marketplace nationwide. As the number of states moving toward legalization rises, the number of cannabis related businesses (CRBs) multiplies, and public acceptance of legalization increases, it is imperative that the insurance industry understand and normalize cannabis coverage.

Members Influence Inland Marine Upgrades

Nov 9, 2021 / by Bob Guevara posted in Issues & Trends, Inland Marine, New/Emerging Risks, P&C Insurers, AAIS News & Views, AAIS Insights, Insurance Line of Business, Builders Risk

AAIS continues to evolve its offerings in the Inland Marine (IM) space, where it has long been an industry leader. Our most recent product update includes a Defective Design and Construction Coverage endorsement to go with a Builders’ Risk policy. This enhancement is a result of input and engagement by Members who were looking for something similar to the LEG 3 (London Engineering Group) endorsement. Its intent is to narrow a policy’s automatic exclusion, providing broader coverage for materials, workmanship, and faulty design during construction, making it easier for insureds to be made whole. The Defective Design and Construction Coverage endorsement is available for large and mid-size construction projects when traditionally, it was available only for large projects.

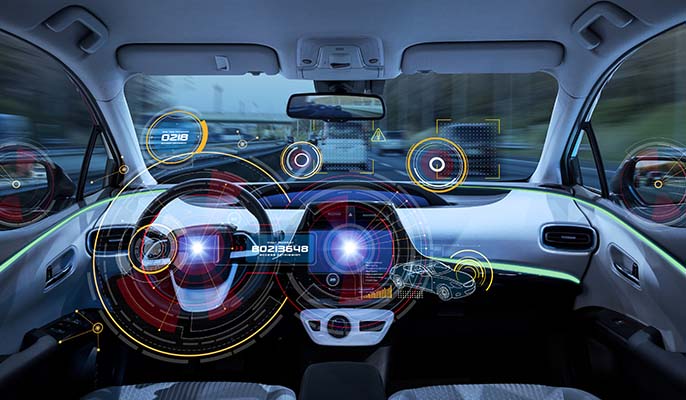

Keeping Pace with the Evolving Auto Industry

Nov 2, 2021 / by Ash Naik posted in Community, Technology, Issues & Trends, Data & Technology, Tech News, Telematics, P&C Insurers, Auto, Commercial Auto, AAIS News & Views, AAIS Insights, Personal Auto, Data/Tech, Insurance Line of Business

A Fast-Moving Auto Industry Presents Challenges and Opportunities

The automotive industry transformation continues to have significant repercussions in the insurance industry. With improving sophistication in car technology, telematics, and consumer behaviors, insurance carriers face new and unprecedented challenges spanning the entire lifecycle of the policy from research to claims. Still, personal and commercial auto insurance remain the industry bellwether as the largest product lines accounting for more than $300 billion in annual premiums.

Blockchain: The Next Big Thing

Oct 8, 2021 / by Robin Westcott posted in openIDL, Issues & Trends, Data & Technology, Data Management/Distributed Ledger, Tech News, Regulatory/Compliance, Blockchain, Data/Tech, Modeling/Actuarial

In August, AAIS Views detailed the results of our hugely successful Proof of Concept (POC) for openIDL (Open Insurance Data Link) that proved the blockchain technology can dramatically improve the insurance regulatory reporting proves for insurers and regulators. We also saw that insurer information could be correlated with data from other sources to reveal deeper insights, and that data could be leveraged by regulators, while remaining private, secure and in full control of participating carriers

A Conversation with...AAIS Chief Pricing Actuary, Michael Payne

Sep 9, 2021 / by Michael Payne posted in openIDL, Insurance, Issues & Trends, Data & Technology, Blockchain, Data, Modeling/Actuarial, Risk, AAIS Views, risk management, Actuarial

This is the next installment in a series of conversations with AAIS leadership to get to know them, their background, and the unique work they’re doing within AAIS to further the insurance industry. In this edition, AAIS Views spoke with Michael Payne, Chief Pricing Actuary, about his career, being creative as an actuary, the role data is playing to create better pricing models, and how AAIS is leveraging those models to deliver value to our Members.

Tell us about your background.

Michael Payne: When I was in college, I liked math, but really didn’t know what I wanted to do. Then I heard about Actuarial Science from an alum who came back to campus and gave a presentation about the career path. That’s what sparked my interest. I got an internship at Zurich and that turned into my first job out of school. I started out doing pricing at Zurich, went to SCOR Re to do reinsurance pricing, and went back to Zurich to eventually lead a pricing tools team.

One not-so-traditional role in my career was a stint I did at Sears in their Home Services unit where I was the Director of Underwriting Analysis. Basically, if you bought a refrigerator at Sears, they were going to offer you a protection plan. It was my role to figure out the prices for those protection agreements based on how likely the appliance was going to need to be repaired or even replaced.

Overall, I really like pricing. It’s prospective in nature as you try to determine what might happen in the future.

In the winter of 2018, I joined AAIS where I’ve been able to leverage my pricing experience. My role includes product development and delivering loss costs that are appropriate for the coverage being offered. Not all carriers have a large team of actuaries or loads of data, so our rating plans offer them a faster speed to market for a new line of business, or even insurtechs to get their first policies written.

Concerns and Opportunities Related to Pandemic Coverage

Aug 3, 2021 / by Nicole Milos posted in Community, Issues & Trends, COVID-19, Regulatory/Compliance, New/Emerging Risks, Legislation & Regulation, AAIS News & Views, AAIS Insights, AAIS Webinar Series, pandemic, Business Interruption, AAIS Views, GLC

While the U.S. economy slowly returns to normal following the COVID-19 pandemic, the insurance industry continues to grapple with business interruption claims, court battles and the future of pandemic-related insurance. In Part II of our two-part Advisory Report, Nicole Milos, Assistant Counsel at AAIS, explains the systemic risk global pandemics pose to the insurance industry and how we’re leveraging data gathered during the pandemic to meet customer demand for future pandemic-type coverage.

Exploring Agile: Software Development for Streamlining Success

Jul 8, 2020 / by Travis Rigas posted in Community, Issues & Trends, Working in Insurance, P&C Insurers, Industry, Business, AAIS News & Views, AAIS Insights, Rally, Agile, Executive, AAIS Views

At AAIS, we’re continually refining our best-in-class products and services to better meet the needs of our Members in a quickly changing industry. In January of 2013, we recognized the need to improve our work processes in order to respond to growing market demand. That’s when AAIS adopted Agile as a new approach to project management.

Cannabis Coverage is Lighting Up the Insurance Industry

Jun 17, 2020 / by Phil Skaggs posted in Issues & Trends, New/Emerging Risks, Cannabis, CannaBOP, Farm & Ag, Commercial Lines, Industry

An increasing number of states are legalizing the use of medicinal and recreational cannabis, creating the opportunity for new business ventures and the need for reliable insurance coverage as the industry expands and matures.

A Data-Driven Future: 2020 Auto Trends

Jun 16, 2020 / by Casey Brewer posted in Issues & Trends, Data & Technology, Insurtech, Telematics, P&C Insurers, Auto, Commercial Auto, Data/Tech, Data Management, 2020 VME, TNEDICCA, AAIS Views

The auto industry is fueling up for new technology down the road. Fully autonomous vehicles and advanced crash-data analysis will all impact not only how the industry operates, but how it is insured as well.