In a recent AAIS Webinar, industry leaders from Britecore, East Tennessee Mutual and Friends Cove Mutual discussed ‘How Small Insurers Can Compete and Win the Customer of the Future.’

AAIS

Recent Posts

Britecore, East Tennessee Mutual and Friends Cove Mutual Execs Talk about Technologies that Help Them Compete

Jun 16, 2022 / by AAIS posted in Data/Tech, BriteCore, Economy, East Tennessee Mutual, Friends Cove, Legacy Systems, Insurance Agents, Insurance Market, NatCats

Greater New York Mutual CEO Provides Insights on Today’s Insurance Market

May 31, 2022 / by AAIS posted in Technology, Issues & Trends, Insurtech, Legislation & Regulation, Economy, AAIS Views, wildfire, social inflation, talent gap, NYIA, Merchants Insurance Group, Greater New York Mutual, supply chain

In this AAIS Market Report, Chair, President and CEO of Greater New York Mutual Elizabeth Heck discusses challenges to the insurance industry in the U.S. and New York.

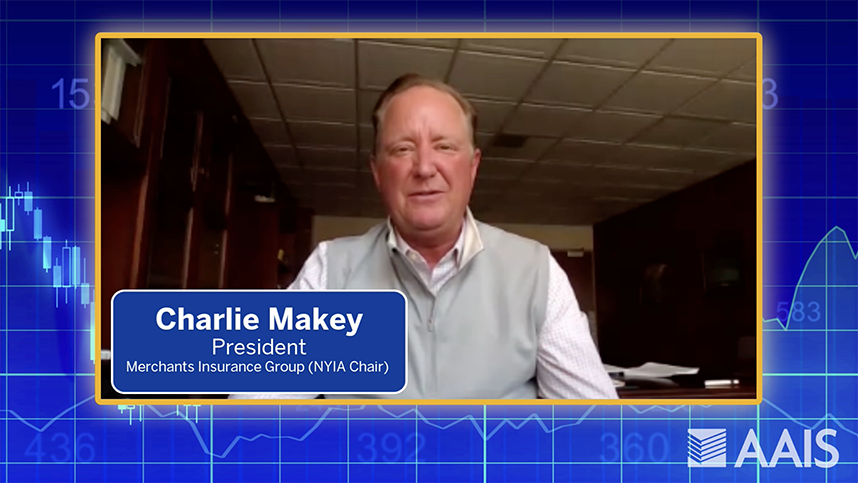

Merchants Insurance Group President Discusses U.S. and New York Insurance Markets

May 24, 2022 / by AAIS posted in Issues & Trends, Legislation & Regulation, Economy, AAIS Views, talent, talent gap, NYIA, Merchants Insurance Group

In this AAIS Market Report, Merchants Insurance Group President, and New York Insurance Association (NYIA) Chair, Charles Makey, discusses issues and challenges facing the U.S. and New York insurance markets, including legislation, regulation, and much more.

AAIS Interviews NYIA President About Pressing Topics

May 19, 2022 / by AAIS posted in Issues & Trends, COVID-19, Legislation & Regulation, pandemic, AAIS Views, NYIA, Insurance Market

In this AAIS Market Report, New York Insurance Association (NYIA) President Ellen Melchionni discusses issues and challenges facing the U.S. and New York insurance markets, legislation and regulation, and much more.

Hanover Exec Discusses Current Data and Info-Sharing Trends

May 4, 2022 / by AAIS posted in openIDL, Technology, Data & Technology, Data Management/Distributed Ledger, Insurance News/Current Events, Tech News, Regulatory/Compliance, AAIS Pulse, Data/Tech, Analytics Insurance, Regulators, The Hanover, Regulatory Reporting, Democratization of Data, GLC

On a recent edition of AAIS Pulse, The Hanover SVP Scott Grieco sat down with AAIS SVP Operations, Joan Zerkovich, for a “Tech Talk” discussing current technology trends, and methods for modernizing the way insurers think about data and information sharing.

Crawford CEO Provides Market Report

May 2, 2022 / by AAIS posted in Insights, Technology, Insurance, Data & Technology, COVID-19, Telematics, Climate Change, Auto, Innovation, AAIS Pulse, pandemic, Economy, auto insurance, NatCats

On a recent edition of AAIS Pulse, Crawford & Company CEO Rohit Verma and AAIS VP of Products John Kadous sat down to discuss the state of the insurance market, including topics such as the economy and supply chain, auto risks, climate change and natural catastrophes, data, and technology, and much more.

NAIC CEO Shares Insights on Insurance Regulation

Apr 28, 2022 / by AAIS posted in openIDL, Insights, Issues & Trends, Data & Technology, COVID-19, Homeowners, Climate Change, Cannabis, Auto, AAIS News & Views, AAIS Pulse, Data/Tech, NAIC, Regulation, pandemic, Regulators, Business Interruption, Economy, Cannabis Insurance, cyber insurnace

On a recent edition of AAIS Pulse, NAIC CEO Mike Consedine sat down with AAIS President and CEO Ed Kelly to share his insights on major regulatory issues facing the insurance industry and the NAIC.

A Conversation with Bob Guevara, AAIS VP, Inland Marine

Apr 26, 2022 / by AAIS posted in openIDL, Insurance, Data & Technology, Inland Marine, Tech News, Commercial Lines, Data, Data/Tech, IMUA, AAIS Views

There is no understating Bob Guevara’s contributions to AAIS and the Inland Marine insurance community: He transformed thinking about inland marine risks, raising awareness with regulators and creating new rating paradigms and valuable tools and resources for AAIS Member insurers. As he looks forward to retiring after 29 years, and transitions to a consulting role, continuing to support AAIS, Bob spoke with AAIS Views.

Let’s start at the beginning. What first drew you to the insurance industry?

Bob Guevara: When I graduated from college in the 1970s the country was coming out of a recession. There was a lot of instability out there. I wanted to join an industry that would be very stable for the long haul, which led me to insurance. I’ve been in the business ever since – 15 years of inland marine underwriting and 29 at AAIS.

IMUA Chair & CEO Discuss Changes in the Inland Marine Market

Apr 19, 2022 / by AAIS posted in Insights, Issues & Trends, Data & Technology, Inland Marine, Insurance News/Current Events, COVID-19, AAIS News & Views, AAIS Insights, IMUA

In this edition of CEO Angles, the topic turns to the tremendous changes affecting the Inland Marine insurance market. From supply chain issues and driver shortages to government infrastructure spending, automation, even cryptocurrency, all are putting pressure on inland marine underwriters to respond.

Using Data to Build Better Fire Protection

Apr 18, 2022 / by AAIS posted in Insights, Technology, Issues & Trends, Data & Technology, Insurance News/Current Events, Fire, AAIS News & Views, AAIS Insights, wildfire, Florida Insurance Market, NatCats

Dr. Matt Hinds-Aldrich, Senior Risk Strategy Lead, was a recent guest on the FNO: InsureTech podcast, joining hosts Rob Beller and Lee Boyd to talk about how new thinking around data can enhance insurers’ ability to measure, rate, and mitigate fire risk and the challenges associated with insuring the peril, particularly in wildfire-prone areas such as California.