AAIS was proud to sponsor the 2024 Florida Insurance Market Summit (FIMS) on March 13-15. Prior to the FIMS meeting, AAIS polled attendees to get a sense of the major issues facing the Florida insurance market in 2024, and the data and technology priorities paving the path ahead.

Overall, there was a consensus around the challenges we face, and the use of new and emerging technologies being deployed. According to respondents, the Florida Homeowners Insurance Market, Reinsurance/Capital, and Climate Risk/Natural Catastrophe Exposure were top concerns. Data Integrity/Accuracy and Accuracy of Risk Models were the top two data & technology priorities for respondents.

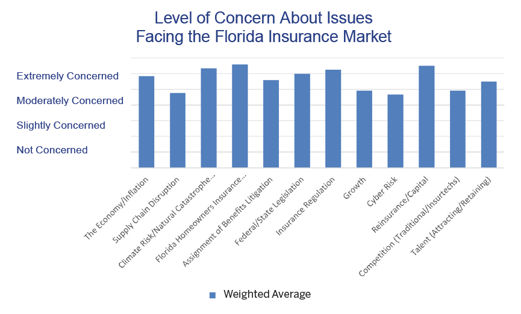

Leading Concerns About the Florida Insurance Market

It appears not much has changed over the past year with regard to the issues facing the Florida market. In our 2023 survey, respondents’ top concerns were the Florida Homeowners Insurance Market, followed by Reinsurance/ Capital, Assignment of Benefits Litigation, Insurance Regulation, Climate Risk/Natural Catastrophes, and then the Economy/Inflation.

More than 80% of respondents were at least Moderately Concerned about the Florida Homeowners Market. Slightly fewer view Reinsurance/Capital as a major concern.

Assignment of Benefits Litigation dropped from third in 2023 to seventh place among the top concerns in 2024. Moving higher among concerns are Climate Risk/Natural Catastrophe Exposures, with more than 70% now saying they are Extremely or Moderately Concerned.

Insurance Regulation and Federal/State Legislation garnered similar levels of concern with more than 30% of respondents Extremely Concerned. The Economy/Inflation remained a concern to respondents in 2023, with just 20% being Extremely Concerned.

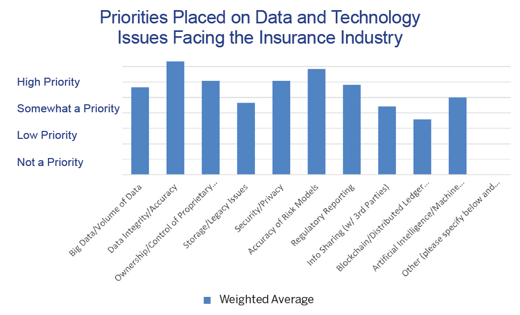

Priority Placed on Data and Technology Issues

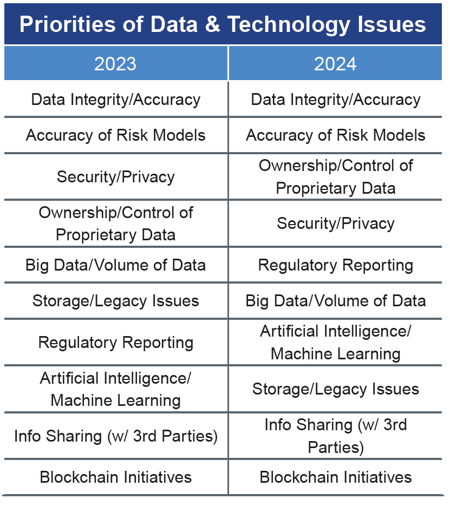

The top Data and Technology issues remained the same year-over-year compared to 2023. Interestingly, nearly all respondents said Data Integrity/Accuracy was at least Somewhat a Priority, while 85% said the same about Accuracy of Risk Models.

More than a third of respondents put Ownership/Control of Proprietary Data as their Top Priority, while only one in five said the same for Security/Privacy.

Regulatory Reporting became a larger priority in 2024, with 69% saying it was at least Somewhat a Priority and one in five reporting it as a Top Priority.

Half of respondents now say Artificial Intelligence/Machine Learning is at least Somewhat a Priority, making it a higher priority than in previous years.

Storage/Legacy Issues is becoming a lesser issue, with more than 68% rating it a Low Priority, or Not a Priority at all. Similarly, Info-Sharing and Blockchain Initiatives are getting little attention, with neither being a Top Priority for any respondents, and the majority making them a Low Priority, or Not a Priority.

For more information on the results of AAIS Market Surveys or any of the advisory products and services offered by AAIS, please contact an AAIS Engagement Manager.