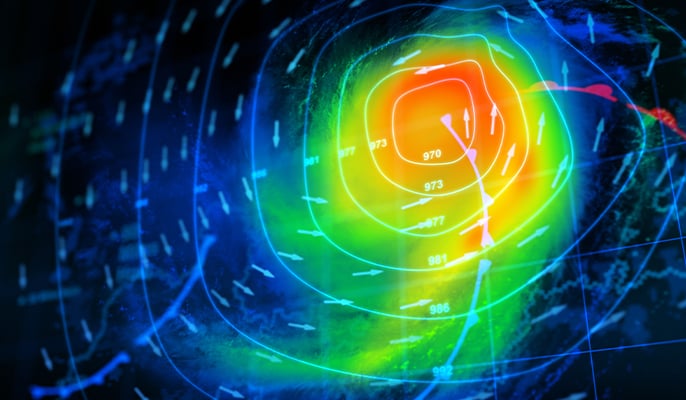

As part of the AAIS Webinar Series, AAIS hosted a virtual presentation on June 13, 2023, featuring AAIS Partner, Davies. Moderated by AAIS Personal Lines Product Manager, Linda Jancik, the session explored how wind models are created, used, and regulated. Featured guest speakers, Greg Fanoe, Director & Consulting Actuary at Davies, Sandra Darby, Property & Casualty Division Actuary at the Maine Bureau of Insurance, and Shaveta Gupta, Catastrophe Risk & Modeling Actuary at the NAIC, discussed how this data is gathered from inside the storm, why it’s collected, and how it is used by insurance carriers to price policies. The panel also analyzed hurricane models from the regulation side, explaining how regulators use this data to develop legislation to further protect consumers and ensure a healthy market.

NatCats

AAIS Webinar ft. Davies: Hurricane Models – Creation, Usage, and Regulation

Jun 28, 2023 / by AAIS posted in AAIS Webinar Series, NAIC, Regulation, hurricanes, catastrophe, NatCats, Actuarial, Davies

Britecore, East Tennessee Mutual and Friends Cove Mutual Execs Talk about Technologies that Help Them Compete

Jun 16, 2022 / by AAIS posted in Data/Tech, BriteCore, Economy, East Tennessee Mutual, Friends Cove, Legacy Systems, Insurance Agents, Insurance Market, NatCats

In a recent AAIS Webinar, industry leaders from Britecore, East Tennessee Mutual and Friends Cove Mutual discussed ‘How Small Insurers Can Compete and Win the Customer of the Future.’

Crawford CEO Provides Market Report

May 2, 2022 / by AAIS posted in Insights, Technology, Insurance, Data & Technology, COVID-19, Telematics, Climate Change, Auto, Innovation, AAIS Pulse, pandemic, Economy, auto insurance, NatCats

On a recent edition of AAIS Pulse, Crawford & Company CEO Rohit Verma and AAIS VP of Products John Kadous sat down to discuss the state of the insurance market, including topics such as the economy and supply chain, auto risks, climate change and natural catastrophes, data, and technology, and much more.

Using Data to Build Better Fire Protection

Apr 18, 2022 / by AAIS posted in Insights, Technology, Issues & Trends, Data & Technology, Insurance News/Current Events, Fire, AAIS News & Views, AAIS Insights, wildfire, Florida Insurance Market, NatCats

Dr. Matt Hinds-Aldrich, Senior Risk Strategy Lead, was a recent guest on the FNO: InsureTech podcast, joining hosts Rob Beller and Lee Boyd to talk about how new thinking around data can enhance insurers’ ability to measure, rate, and mitigate fire risk and the challenges associated with insuring the peril, particularly in wildfire-prone areas such as California.

Colorado State University's Phil Klotzbach Offers Early Clues on Florida Hurricane Season

Apr 6, 2022 / by AAIS posted in Insights, Issues & Trends, Climate Change, P&C Insurers, AAIS News & Views, AAIS Insights, hurricanes, Florida Insurance Market, NatCats

Phil Klotzbach, Research Scientist at the Colorado State University, stopped by The AAIS Executive Roundtable with a preview of the upcoming hurricane season in The Florida Report.

Different Ways Insurers Can Deal With Climate Change

Feb 24, 2022 / by AAIS posted in Community, Technology, Issues & Trends, Homeowners, Climate Change, P&C Insurers, AAIS News & Views, AAIS Insights, Modeling/Actuarial, Insurance Line of Business, Conning, NatCats, Colorado State University

Dr. Phil Klotzbach, Ph. D., from the Department of Atmospheric Science at Colorado State University, says climate change is real. In a recent interview he explained that “if you go back to the late 1800s, parts-per-million of carbon dioxide was about 280; now we're sitting at about 420. We've gone up by about 50 percent of what we were about 140 years ago. With that, we've seen a global temperature rise of about eight- or nine-tenths of a degree Celsius … about 1.5 degrees Fahrenheit.”

'Tis the Season for Community Involvement—and Advisory Councils

Dec 20, 2021 / by Matt Hinds-Aldrich posted in Insights, Issues & Trends, Data & Technology, Homeowners, New/Emerging Risks, Modeling/Predictive Analytics, Fire, AAIS News & Views, AAIS Insights, Modeling/Actuarial, Insurance Line of Business, NatCats, Fire Advisory Council, AAIS FLAMES, AAIS Wildfire Resource Center

With the holidays and the end of the year upon us, it is the time to reflect upon the past year. And it is the time of year we tend to think about coming together, as a community, to share our experiences. In our case, I’m referring to AAIS’s product-focused advisory councils.

Wind or Water? Breaking Down Slab Claims After Hurricanes

Sep 15, 2021 / by Matt Hinds-Aldrich posted in Issues & Trends, Homeowners, New/Emerging Risks, P&C Insurers, AAIS Insights, Insurance Line of Business, Flood Insurance, flood, talent, risk mitigation, hurricanes, hurricane resource center, slab claim, risk awareness service, catastrophe, national flood insurance program, NatCats, AAIS Risk Awareness Service, AAIS Hurricane Resource Center, AAIS Hurricane Live Tracker

Risk Management Service Inc. (RMS) estimates $25 billion to $35 billion in onshore and offshore insured losses in the Gulf of Mexico alone were caused by Hurricane Ida. This doesn’t include the damage to other parts of the country. While the fundamentals of hurricanes are widely understood these days, there remain several important nuances to hurricane losses that are essential to understand for insurers, regulators, and the general public alike. Here we will look at one less understood type of claim from hurricanes – slab claims.

Learning From the Surfside Condo Collapse

Aug 10, 2021 / by Matt Hinds-Aldrich posted in openIDL, Technology, Issues & Trends, Data & Technology, Data Management/Distributed Ledger, Insurance News/Current Events, Blockchain, AAIS Insights, Data/Tech, AAIS Views, wildfire, NatCats

The collapse of the Champlain Towers South condo in Surfside, Florida, shocked the nation, starting a much-needed conversation about the importance of risk mitigation. As the events unfolded, we learned that the information about the significant risk of collapse was known—to some—but simply went unheeded.

AAIS Service Supports Hurricane Risk Assessments, CAT Planning & Event Tracking

Feb 23, 2021 / by AAIS posted in openIDL, Community, Technology, Issues & Trends, Data & Technology, Insurance News/Current Events, Open Source, Insurtech, IoT, Data, Data/Tech, AAIS Views, hurricanes, NatCats

Accurate risk assessment is key to mitigating exposure and to unlocking underwriting opportunities.