Don’t let the beautiful Florida sunshine blind you to the storm brewing in the personal lines property market.

At the recent Florida Insurance Market Summit (FIMS), the legal and governmental consulting firm Colodny Fass presented some sobering statistics regarding the magnitude of the Florida homeowners insurance market “storm” in 2022:

Personal Lines (2)

Florida…A Stormy Insurance Market in Transition

Mar 10, 2023 / by Linda Jancik posted in Personal Lines, Homeowners, Florida Insurance Market, Florida

Advisory Report: Merlinos & Associates Director Ryan Purdy Talks Florida Market & What to Expect in 2023

Feb 7, 2023 / by AAIS posted in Personal Lines, Insurance, Regulatory/Compliance, NAIC, Insurance Advisory, Florida Insurance Market, Regulatory Reporting, Statistical Reporting, Florida

For this Advisory Report, AAIS sat down with Ryan Purdy, Director at Merlinos & Associates - a Davies Company, to discuss key takeaways from the recent Florida Chamber of Commerce Insurance Summit. He also touched on key trends to look for moving into 2023 as well as updates specifically seen across the Florida insurance market.

Crypto, Solar, Tiny Homes Among Personal Lines Market Issues

Mar 3, 2022 / by Linda Jancik posted in Personal Lines, Community, Technology, Issues & Trends, Homeowners, New/Emerging Risks, P&C Insurers, AAIS News & Views, AAIS Insights, Insurance Line of Business, cryptocurrency, Airbnb, tiny homes, solar panels, bikes

Personal lines insurance is more diverse than ever before. During a Personal Lines Product Council in 2022 hosted by AAIS, Member carriers and other key stakeholders discussed several key issues affecting the market, from cryptocurrency and solar panels to container homes, “swimply”, and e-bikes and scooters.

AAIS established Product Advisory Councils to bring Member carriers and other industry stakeholders together to identify the burgeoning issues concerning insurers and the broader insurance industry today. While not all issues raised can be solved through product or program developments, we believe discussing emerging issues as well as working together within the AAIS Community can spawn new ideas and usher resources to meet today’s challenges. A general overview of several emerging issues is discussed below.

AM Best Webinar: Closing the Flood Insurance Coverage Gap

Jul 29, 2021 / by AAIS posted in Personal Lines, Issues & Trends, Homeowners, Climate Change, P&C Insurers, Industry, Data, Insurance Line of Business, Flood Insurance, AM Best, munich re, flood, AAIS Views

Flood insurance has long been primarily administered by the National Flood Insurance Program (NFIP), which has 5.1 million policies in force. But the landscape for flood insurance – and who needs it – is changing. This was the topic of an AM Best webinar that included Linda Jancik, AAIS Personal Lines Product Manager, Serena Garrahan, Vice President, Inland Flood Product Manager at Munich Re US, and Rob Olson, Senior Research Analyst at International Risk Management Institute (IRMI).

Cyber Insurance: Where are we now?

May 21, 2021 / by AAIS posted in Personal Lines, Issues & Trends, Cyber, New/Emerging Risks, P&C Insurers, Berkley Re, AAIS Views, Cyber Crime

During the height of the COVID pandemic, Berkley Re Solutions’ Jeff Cron joined AAIS for a an AAIS Pulse session looking at ‘Cyber Crime: The Online Home Invasion.’ "We’re all online more, seeing content, and clicking links to different articles, videos, and other forms of media. While the actual risk hasn’t changed, volume has magnified, with more scams and more screen time.”

Cyber Insurance Starting to Find A Practical Footing

Jan 28, 2021 / by AAIS posted in Personal Lines, Community, Issues & Trends, COVID-19, IoT, Homeowners, Cyber, New/Emerging Risks, P&C Insurers, Remote Work, Cyber Fortress, Berkley Re, CyberPolicy, AAIS Views

Imagine this: You’re working from home, like many others during the COVID-19 pandemic. Your children are also home, remote learning. One of your kids falls prey to malware, infecting your entire network with a virus. Your at-home business’s website is shut down for eight hours. You sigh a breath of relief, thankful that your insurance will cover the costs… or does it?

Cyber Crime: The Online Home Invasion

Jan 4, 2021 / by AAIS posted in Personal Lines, Technology, Issues & Trends, Data & Technology, IoT, Homeowners, Cyber, New/Emerging Risks, AAIS Insights, AAIS Pulse, Berkley Re, Insurance Line of Business, CyberScout, AAIS Views, cyber risk

With an increasing number of employees working from home, there has also been an alarming increase in personal and professional cybercrime exposure. At the September 2020 AAIS Pulse, AAIS Personal Lines Product Manager Linda Jancik hosted a panel of cyber-focused leaders, including CyberScout’s Eric Warbasse and Berkley Re Solutions’ Jeff Cron and Chris Ellis to discuss the rise of cyber threats, future predictions, and how carriers can protect their customers from emerging digital exposures.

Introducing Risk

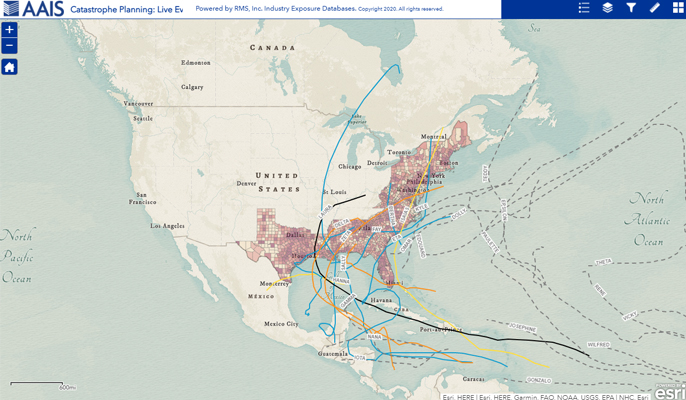

Jun 30, 2020 / by Phil LeGrone posted in Personal Lines, Insurance, AAIS Views, AAIS Risk Awareness Service, AAIS Live Event Tracker Map

It’s common to hear the phrase, ‘the world is getting more complex every day’…so much that it’s become cliché. That is, unless it’s your job to try to understand, quantify, and insure the perils that come from that complexity. We know you’re looking for actionable insights to protect your business. The problem is typically not the lack of information about these perils but rather, the information overload that makes it a challenge to to find timely, relevant, and reliable insights that you can use to make informed decisions. You rely on AAIS for advisory expertise on the products your customers use, and now we’re inviting you to try our new Risk Awareness Service, our latest tool to help our Members maintain your competitive advantage.

Emerging Cyber Exposures

Jun 29, 2020 / by Linda Jancik posted in Personal Lines, Community, Issues & Trends, Data & Technology, IoT, Homeowners, Cyber, New/Emerging Risks, Underwriting, Berkley Re, AAIS Views, AAIS Family Cyber Protection Program

As today’s families fall asleep at night, they rest assured that they are protected from home perils. When thinking about keeping our homes safe, many think of the standard home perils: fire, floods, and burglary. However, as we delve further into the age of technology, many people forget that their homes are susceptible to more than physical perils. Danger can lurk within their phones, computers, and other IoT devices.

Safe at Home, Safe Online: Smart Homes, Sensors, and IoT

Jun 15, 2020 / by Linda Jancik posted in Personal Lines, Community, Technology, Issues & Trends, Data & Technology, IoT, Homeowners, Telematics, Cyber, P&C Insurers, Security, Data Management, 2020 VME, AAIS Views, NatCats, CFM Insurance, Roost, Neos

Advancements in technology have brought great strength to home security systems, transforming what we once considered an average house into a modern smart home.