During the height of the COVID pandemic, Berkley Re Solutions’ Jeff Cron joined AAIS for a an AAIS Pulse session looking at ‘Cyber Crime: The Online Home Invasion.’ "We’re all online more, seeing content, and clicking links to different articles, videos, and other forms of media. While the actual risk hasn’t changed, volume has magnified, with more scams and more screen time.”

Issues & Trends (9)

Cyber Insurance: Where are we now?

May 21, 2021 / by AAIS posted in Personal Lines, Issues & Trends, Cyber, New/Emerging Risks, P&C Insurers, Berkley Re, AAIS Views, Cyber Crime

openIDL Elevates to Linux Foundation Project

Apr 19, 2021 / by AAIS posted in openIDL, Technology, Issues & Trends, Data & Technology, Data Management/Distributed Ledger, Open Source, Insurtech, Blockchain, Data, Security, AAIS Pulse, Data/Tech, Insurance Services/TPAs, CyberPolicy, Linux Foundation, Hyperledger

AAIS CEO Ed Kelly opened the April 13 edition of AAIS Pulse newsmagazine with an exciting announcement: AAIS has launched openIDL as a Linux Foundation project. The Linux Foundation is the preeminent nonprofit consortium supporting one-source technologies that drive innovation and transform industries.

The Value of Risk Control: Moving Beyond the Basics

Mar 15, 2021 / by AAIS posted in Community, Technology, Issues & Trends, Data & Technology, COVID-19, New/Emerging Risks, AAIS Webinar Series, Underwriting, Risk, Agents, RCT, EMC, AAIS Views, Risk Control Technologies, Risk Control

In this edition from the AAIS Webinar Series, titled: The Value of Risk Control: Moving Beyond the Basics, Bryon Snethen, Vice President Risk Improvement at EMC Insurance and Jacob Pereira, a Solutions Engineer at Risk Control Technologies identified the purpose and value of risk control to a variety of stakeholders, including agents, insurance companies, policyholders, and society.

Capitol Outlook with Faegre Drinker Partner Patrick Hughes

Mar 3, 2021 / by AAIS posted in Insights, Issues & Trends, Insurance News/Current Events, COVID-19, Regulatory/Compliance, Industry, Legislation & Regulation, AAIS Pulse, Compliance, Government, Faegre Drinker, AAIS Views, GLC

During the February 2021 AAIS Pulse newsmagazine, AAIS VP and General Counsel Robin Westcott was joined by Faegre Drinker Partner Patrick Hughes to examine the impact of the Biden Administration and recent legislative actions on the insurance industry.

Leveraging Open Source Technology: Obstacles and Opportunities

Mar 3, 2021 / by AAIS posted in openIDL, Community, Technology, Issues & Trends, Data & Technology, Data Management/Distributed Ledger, Open Source, Tech News, Insurtech, Regulatory/Compliance, Blockchain, Data, Innovation, AAIS Pulse, Data/Tech, Compliance, Travelers, Data Call, Linux Foundation, Hyperledger, AAIS Views

During the February 2021 AAIS Pulse newsmagazine, AAIS VP Truman Esmond was joined by Brian Behlendorf, Executive Director of Hyperledger, Brian Hoffman, Vice President State and Bureau Regulatory Affairs, at Travelers, and Arron Lamp, Vice President Enterprise Business Intelligence & Analytics & Operations, at Travelers, to discuss the obstacles and opportunities around leveraging open-source technology.

CEO Angles: Big “I” CEO Explains Concerns About the New Direction in Washington

Mar 3, 2021 / by AAIS posted in Insurance, Issues & Trends, Insurance News/Current Events, COVID-19, Working in Insurance, Legislation & Regulation, AAIS Pulse, AAIS Webinar Series, Agents, Brokers, Government, Flood Insurance, Taxes, Economy, AAIS Views, Big I

AAIS CEO Ed Kelly sat down with Bob Rusbuldt, CEO of the Independent Insurance Agents & Brokers of America (Big I) to discuss the impact of the Biden Administration and COVID-19 on insurers – and what may be ahead in the legislative and regulatory arena.

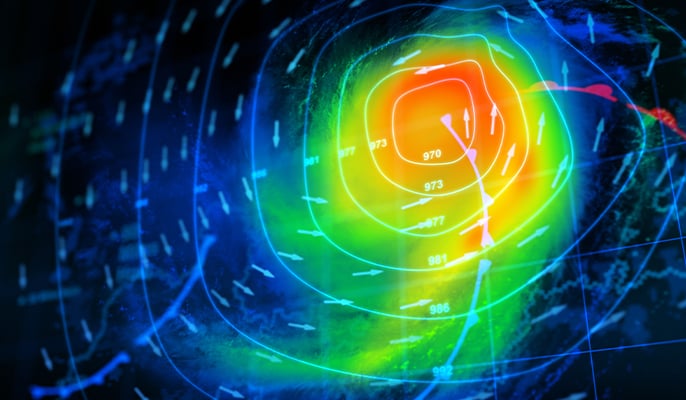

AAIS Service Supports Hurricane Risk Assessments, CAT Planning & Event Tracking

Feb 23, 2021 / by AAIS posted in openIDL, Community, Technology, Issues & Trends, Data & Technology, Insurance News/Current Events, Open Source, Insurtech, IoT, Data, Data/Tech, AAIS Views, hurricanes, NatCats

Accurate risk assessment is key to mitigating exposure and to unlocking underwriting opportunities.

Cyber Insurance Starting to Find A Practical Footing

Jan 28, 2021 / by AAIS posted in Personal Lines, Community, Issues & Trends, COVID-19, IoT, Homeowners, Cyber, New/Emerging Risks, P&C Insurers, Remote Work, Cyber Fortress, Berkley Re, CyberPolicy, AAIS Views

Imagine this: You’re working from home, like many others during the COVID-19 pandemic. Your children are also home, remote learning. One of your kids falls prey to malware, infecting your entire network with a virus. Your at-home business’s website is shut down for eight hours. You sigh a breath of relief, thankful that your insurance will cover the costs… or does it?

IMUA, Allianz Leaders Talk Inland Marine Market

Jan 28, 2021 / by AAIS posted in Community, Issues & Trends, Inland Marine, Industry Associations, Working in Insurance, IMUA, Allianz, AAIS Views, Legacy Systems

AAIS has been a longtime supporter of the Inland Marine Underwriters Association (IMUA). The national association provides exemplary curriculum, training, and resources to strengthen underwriting in inland marine insurance. Every year, the IMUA holds an annual meeting to provide educational opportunities for professionals of all inland marine backgrounds.

Agile Methodology

Jan 25, 2021 / by AAIS posted in Issues & Trends, Working in Insurance, AAIS Culture, Agile, Remote Work, Distributed Workforce, AAIS Views

At AAIS, we’re continually refining our industry-leading products to better serve our Members, developing new products to respond to a quickly changing industry, and building new processes to deliver the best-in-class service and support our Members have come to expect.