Cannabis is a multi-billion-dollar market that continues to be underserved by the insurance industry. While the majority of states and the District of Columbia have legalized cannabis in one form or another, less than 30 insurers are participating in the marketplace nationwide. As the number of states moving toward legalization rises, the number of cannabis related businesses (CRBs) multiplies, and public acceptance of legalization increases, it is imperative that the insurance industry understand and normalize cannabis coverage.

AAIS Insights (6)

Cannabis Coverage…Worth the Risk

Nov 15, 2021 / by Joe Jonas posted in Community, Issues & Trends, Regulatory/Compliance, Cannabis, P&C Insurers, Commercial Lines, Legislation & Regulation, AAIS News & Views, AAIS Insights, Insurance Line of Business

Climate Change & Insurance…What’s Being Done About It

Nov 11, 2021 / by AAIS posted in Issues & Trends, Industry Associations, Regulatory/Compliance, Homeowners, New/Emerging Risks, P&C Insurers, Legislation & Regulation, AAIS News & Views, AAIS Insights, AAIS Pulse, Berkley Re, Insurance Line of Business, munich re, University of South Carolina

Research from NASA points to several factors that support climate change from rising sea levels to warming oceans and glacial retreats. The effects of climate change have a significant impact on the insurance industry, which generates considerable premium, expense, and losses based on insured catastrophes. As these events become more unpredictable and severe, the industry must adapt.

Members Influence Inland Marine Upgrades

Nov 9, 2021 / by Bob Guevara posted in Issues & Trends, Inland Marine, New/Emerging Risks, P&C Insurers, AAIS News & Views, AAIS Insights, Insurance Line of Business, Builders Risk

AAIS continues to evolve its offerings in the Inland Marine (IM) space, where it has long been an industry leader. Our most recent product update includes a Defective Design and Construction Coverage endorsement to go with a Builders’ Risk policy. This enhancement is a result of input and engagement by Members who were looking for something similar to the LEG 3 (London Engineering Group) endorsement. Its intent is to narrow a policy’s automatic exclusion, providing broader coverage for materials, workmanship, and faulty design during construction, making it easier for insureds to be made whole. The Defective Design and Construction Coverage endorsement is available for large and mid-size construction projects when traditionally, it was available only for large projects.

Bridging the Talent Gap in Insurance

Nov 4, 2021 / by AAIS posted in Issues & Trends, Insurance News/Current Events, Insurance Operations, Working in Insurance, AAIS News & Views, AAIS Insights, AAIS Pulse, talent, talent gap, University of South Carolina

In July 2020, consulting firm McKinsey & Company put out a report detailing the talent transformation within the insurance industry. The topline message: Talent strategy is as important as business strategy.

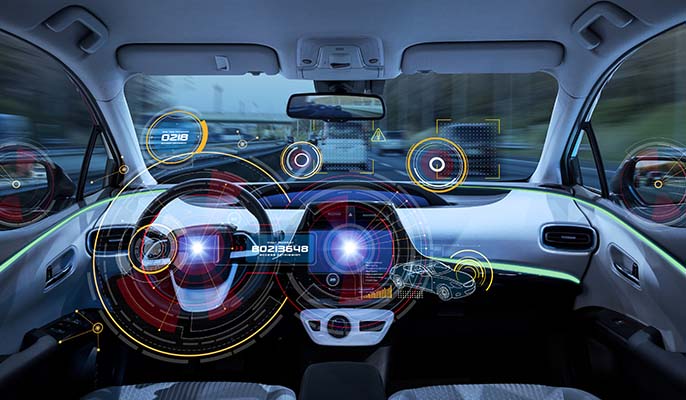

Keeping Pace with the Evolving Auto Industry

Nov 2, 2021 / by Ash Naik posted in Community, Technology, Issues & Trends, Data & Technology, Tech News, Telematics, P&C Insurers, Auto, Commercial Auto, AAIS News & Views, AAIS Insights, Personal Auto, Data/Tech, Insurance Line of Business

A Fast-Moving Auto Industry Presents Challenges and Opportunities

The automotive industry transformation continues to have significant repercussions in the insurance industry. With improving sophistication in car technology, telematics, and consumer behaviors, insurance carriers face new and unprecedented challenges spanning the entire lifecycle of the policy from research to claims. Still, personal and commercial auto insurance remain the industry bellwether as the largest product lines accounting for more than $300 billion in annual premiums.

The Distributed Workforce: Change Has Come

Oct 28, 2021 / by AAIS posted in Issues & Trends, Data & Technology, Insurance Operations, Working in Insurance, P&C Insurers, AAIS News & Views, AAIS Insights, Distributed Workforce, talent

A distributed workforce, also known as telecommuting or remote work, occurs when a business has employees that work in different locations (e.g., their home, satellite offices, etc.). This is an idea that AAIS has embraced successfully for nine years before the COVID-19 pandemic. The long-held belief that collaboration can only happen in person in a single location is no longer the case.

Insurance Industry Grapples with Discrimination, But Change is Underway

Oct 26, 2021 / by AAIS posted in Community, Issues & Trends, Insurance News/Current Events, Industry Associations, Regulatory/Compliance, Insurance Operations, Working in Insurance, P&C Insurers, AAIS Insights, Business Interruption, DEI

Diversity, equity, and inclusion (DEI) continue to be a concern in our society, and the issues it presents extend beyond the communities where we live to the places and industries where we work. In 2021, AAIS Director of Government Relations Lori Dreaver Munn presented at the Association of Insurance Compliance Professionals (AICP) Annual Conference on a more nuanced concern – improving DEI in insurance products.

AAIS, Berkley Re & Munich Re Experts Talk Cyber, Fire & Flood Risk

Oct 20, 2021 / by AAIS posted in Machine Learning/AI, Issues & Trends, Data & Technology, AAIS Events, Events, Tech News, Homeowners, New/Emerging Risks, Climate Change, P&C Insurers, Fire, AAIS Insights, AAIS Pulse, AAIS Event Archives, Data/Tech, Berkley Re, Insurance Line of Business, munich re, flood

The AAIS Pulse newsmagazine recently featured a discussion with experts from Munich Re, Berkley Re Solutions, and AAIS hosted by AAIS Vice President of Products John Kadous on the emerging risks affecting policyholders in the homeowners market. The focus was on the evolving threats around cyber, fire and flood and how they’re being impacted by climate change, technology and more.

Maryland Insurance Commissioner Talks Talent, E-Commerce, Insurtech & More

Oct 18, 2021 / by AAIS posted in Machine Learning/AI, Issues & Trends, Data & Technology, AAIS Events, Events, Tech News, Insurtech, Regulatory/Compliance, New/Emerging Risks, Working in Insurance, Legislation & Regulation, AAIS Insights, AAIS Pulse, AAIS Event Archives, Data/Tech, NAIC, talent

The AAIS Pulse newsmagazine recently featured a discussion between Maryland Insurance Commissioner Kathleen Birrane and AAIS VP of Government, Legal and Compliance Robin Westcott. They covered a range of topics, from careers in insurance and climate change to National Association of Insurance Commissioner Working Groups, technology, insurtechs and much more.

Wind or Water? Breaking Down Slab Claims After Hurricanes

Sep 15, 2021 / by Matt Hinds-Aldrich posted in Issues & Trends, Homeowners, New/Emerging Risks, P&C Insurers, AAIS Insights, Insurance Line of Business, Flood Insurance, flood, talent, risk mitigation, hurricanes, hurricane resource center, slab claim, risk awareness service, catastrophe, national flood insurance program, NatCats, AAIS Risk Awareness Service, AAIS Hurricane Resource Center, AAIS Hurricane Live Tracker

Risk Management Service Inc. (RMS) estimates $25 billion to $35 billion in onshore and offshore insured losses in the Gulf of Mexico alone were caused by Hurricane Ida. This doesn’t include the damage to other parts of the country. While the fundamentals of hurricanes are widely understood these days, there remain several important nuances to hurricane losses that are essential to understand for insurers, regulators, and the general public alike. Here we will look at one less understood type of claim from hurricanes – slab claims.